Part A: Background

PREVIOUS | NEXT | Return to CONTENTS

1. Introduction

Why the Inquiry was established

1.1 On 14 September 2017, the underground fuel pipeline that brings petrol, diesel, and jet fuel from the Marsden Point Oil Refinery to Auckland ruptured. The pipeline shut down automatically as soon as its systems detected the sudden loss of pressure.

1.2 The site of the rupture was found quickly. It was in a paddock in Ruakākā, just a few kilometres from the refinery. At the time, the pipeline was transporting jet fuel, which leaked into the paddock. Refinery staff immediately began work to contain the leak and potential environmental damage, and to excavate to find out the extent of the damage.

1.3 It took 10 days to repair the pipeline. During that time, it could not be used to transport fuel to Auckland. The region had to manage with the fuel that was already in storage tanks around Auckland or could be transported in by other means.

1.4 The stocks of ground fuels (the different grades of petrol and diesel) already in Auckland, along with supplies brought in by truck from Marsden Point and the Port of Tauranga, proved adequate to keep industry and fuel retailers supplied. A small number of retail petrol stations ran out of some of the more specialised stock towards the end of the outage.

1.5 Auckland Airport was harder hit. The fuel companies rationed the airlines to 30% of their normal usage from Sunday 17 September.[1] The airlines took steps such as flying in aeroplanes full of fuel without passengers, filling up at nearby airports (for example, in Christchurch, the east coast of Australia, and some Pacific islands), reducing the weight on planes by postponing cargo, and cancelling some flights. All these steps to reduce the impact came at a cost.[2] Some of the travelling public were inconvenienced and some businesses suffered significant losses. Even so, the outage was over within 10 days and the city quickly returned to normal.

1.6 During our work, we heard that several factors made this incident relatively easy to deal with and manageable in its consequences:

- The pipeline contained jet fuel at the time of the rupture, which is much more stable and non-combustible than other fuels. If it had ruptured when carrying petrol, there would have been more risk of environmental damage, the formation of a vapour cloud, and an explosion. That was particularly relevant at this Ruakākā site, because the same trench contains a natural gas pipeline and there are power lines overhead. An explosion at this site could have damaged all of these.

- The rupture site was reasonably close to the refinery, on level ground, and easy to access, so staff and emergency crews were able to get there and respond quickly. If the rupture had happened in a more remote or inaccessible location, containing the spill and repairing the pipe would have been much more difficult.

- The outage happened at a quiet point in the travelling calendar, outside all holiday periods (when passenger numbers are higher). The peak season begins in December, at which point demand for jet fuel is much higher and a loss of supply would have been more difficult for the airlines to manage.

- When the outage occurred, the jet fuel tanks at the Wiri storage facility were full. One storage tank at the airport was out of service, but overall, jet fuel stocks in Auckland were good. If the outage had happened at another point in the supply cycle (for example, if a tank had been low and waiting to be filled, or if one had been out for service), the available stocks would have been much lower.

1.7 The incident raised questions about whether the current arrangements for supply left New Zealand’s major city too vulnerable to disruption. There was particular concern about the risks for the supply of jet fuel to the country’s main international airport, Auckland Airport. The Government established this Inquiry because the outage highlighted that the fuel supply can be vulnerable to disruptions and that effective risk management practices and contingency plans need to be in place.

What the Inquiry covered

1.8 The Inquiry was established by the Minister of Energy and Resources, Hon Dr Megan Woods, by a Gazette notice on 6 December 2018. The terms of reference stated:[3]

The purpose of this Inquiry is to draw lessons from the RAP [Refinery to Auckland Pipeline] outage to inform how the fuel industry and the Government could improve the resilience of fuel supply in the Auckland region.

1.9 To do this, the terms of reference required us to inquire into:

- the cause(s), contributory factor(s) and impacts of the RAP outage;

- the operational responses to the outage; and

- the relevant operational and risk management practices of Refining NZ, fuel suppliers, airlines, national and regional civil defence and emergency management (CDEM) organisations, and any other relevant parties.

1.10 Taking into account what we learned about the outage and its impact, the Inquiry was then required to “report and make any recommendations it sees fit regarding the resilience of fuel supply in the Auckland region, and any other relevant matters”.

1.11 We could not inquire into, or report on, issues of criminal or civil liability.

1.12 The Inquiry was initially required to report within six months of its establishment. However, the Inquiry was given an extension to complete its work by 19 August 2019.

Why this issue is important

1.13 The whole supply chain that we examined is critical infrastructure for New Zealand. It is recognised as nationally significant in many reports assessing the state of New Zealand infrastructure. For example, the New Zealand Lifelines Council identified all the components, from the Marsden Point wharf through to the jet fuel link at Auckland Airport, as “pinch-points”: single sites that would cause a significant loss of national service if they failed.[4]

1.14 Auckland Airport was identified as another pinch-point, because it is the gateway for 75% of international visitors. In 2015, the Thirty Year New Zealand Infrastructure Plan noted that the airport’s operations contributed $3.5 billion to regional GDP and provided 33,100 jobs. Its long-term plans for investing in more infrastructure were expected to increase regional GDP by a further $2 billion.[5]

1.15 In 2017, it was a pipeline that failed and it was repaired in less than two weeks. The disruption could have been worse if another part of the supply chain had failed, such as the storage tanks at Wiri or part of the Marsden Point refinery. The risks include contamination of a tank with faulty product; failure of a component; fire or explosion; and damage by external interference. Some of these events are more likely than others, and the operators of these facilities all take careful steps to minimise the risk. However, as events in Christchurch in March 2019 showed, even the risk of terrorist activity should not be discounted.

1.16 The Ministry of Business, Innovation and Employment (MBIE) commissioned a report on the economic effects of possible fuel supply disruptions.[6]The modelling in this report suggests that in the first six months after an event:

- a short-term refinery outage would result in a $100 million loss for New Zealand;

- a long-term refinery outage would cause a loss of nearly $2.5 billion or 1.8% of GDP; and

- a long-term disruption to the pipeline or the Wiri facility would cause a loss of nearly $1.2 billion or 0.9% of GDP.

1.17 The modelling showed that all these scenarios would also produce a significant loss in welfare, to the extent that those losses can be quantified and modelled. A short-term disruption to the pipeline or the Wiri facility, like that in 2017, produces smaller consequences but still significant losses.[7]

How we carried out this Inquiry

1.18 The Inquiry’s work was made up of five broad stages.

1.19 In the preparation stage, we:

- received initial briefings from government agencies;

- identified and consulted the relevant parties likely to be involved in our work and designated some of those as core participants under the Inquiries Act 2013;[8]

- consulted on and published a List of Issues to guide our work;[9] and

- held introductory meetings between the panel members and the major organisations involved.

1.20 We then moved into an information-gathering stage. As well as our own general research, this involved:

- sending out formal requests for information to 21 parties;

- meeting with 18 parties to carry out formal interviews;

- visiting the Marsden Point refinery and the site of the pipeline rupture;

- visiting the Wiri site, which is the main fuel storage facility for the Auckland region;

- commissioning an independent expert engineer from Australia to review the way the pipeline had been operated;

- commissioning an independent expert from Australia to assess the resilience of the jet fuel supply chain to Auckland Airport and advise on options for improving it;

- holding a closed workshop with selected parties to discuss the expert’s draft report on the resilience of the jet fuel supply chain;

- holding a three-day public forum with the parties to hear and discuss submissions on a narrowed list of issues;[10] and

- meeting with other government agencies in New Zealand and Australia working on related matters.

1.21 The Inquiry records its disappointment that two parties were not fully open with us while we were gathering information. On an issue that we regarded as important to our work – the question of whether a second supply chain for jet fuel might be established – BP and Mobil provided brief and general answers to our questions, both in the formal interviews with us on 2 and 10 May 2019 respectively, and in response to the information requests we made on 1 April 2019, using our statutory powers to require information. By contrast, in its information response and interview, Z Energy told us it was exploring the possibility of a second supply chain through the Port of Tauranga. Although Z Energy told us it had raised the possibility with the other two fuel companies and they were involved in its investigations, we were not told that they were full participants in a joint working group until sometime later.

1.22 In July, we learned that this working group had expanded its focus in May 2019 and begun to discuss possible investments to improve the resilience of the existing infrastructure. This was frustrating, given these were the exact issues the Inquiry had canvassed with the parties in previous months in the interview, workshop, and forum. The fuel companies knew these issues were central to our analysis and the report we were drafting. Once we had learned about the full scope of the working group and made specific requests for information about it using our statutory powers, all three companies provided that information promptly.

1.23 We then analysed the information we had gathered and prepared our own draft report. During this process, we sought further information from some parties.

1.24 The next stage was to consult relevant parties on the draft report, both to confirm its accuracy and to ensure that all those potentially affected by the findings and recommendations had an appropriate opportunity to comment. We carefully considered all the comments we received and went back to parties for further information where necessary.

1.25 We then proceeded to the last stage of our work, which involved revising the report in light of the comments we had received, finalising it, submitting it to the Minister of Energy and Resources by 19 August 2019, and providing her with a presentation on our findings and recommendations.

The structure of this report

1.26 This report is written in five parts:

- Part A sets out background information to explain how fuel is supplied to the Auckland region, the history of how that infrastructure was built, and how it is now owned and operated. It also explains how the Inquiry approached the question of resilience as it carried out its assessment.

- Part B examines the causes of the pipeline rupture. It sets out what we have established about how the pipeline was damaged in August 2014, our views on whether aspects of its operation might have contributed to the eventual rupture, and whether the pipeline is adequately protected. It concludes with our views on what more should be done to protect it.

- Part C covers the response to the rupture in September 2017 against the backdrop of the arrangements in place at the time for responding to crises. It examines the physical response to the rupture, in terms of how the pipeline was repaired, the communication and coordination activities of all those involved, and the steps taken to manage fuel supplies during the outage. The final chapter in Part C discusses our views about what needs to be done to improve preparations for a future incident.

- Part D considers the technical resilience of supply systems that bring ground fuels to Auckland.

- Part E examines the technical resilience of the infrastructure that makes up the jet fuel supply system to Auckland Airport and the options and challenges for creating more resilience in the system.

2. How the Auckland region is supplied with fuel

The overall supply chain

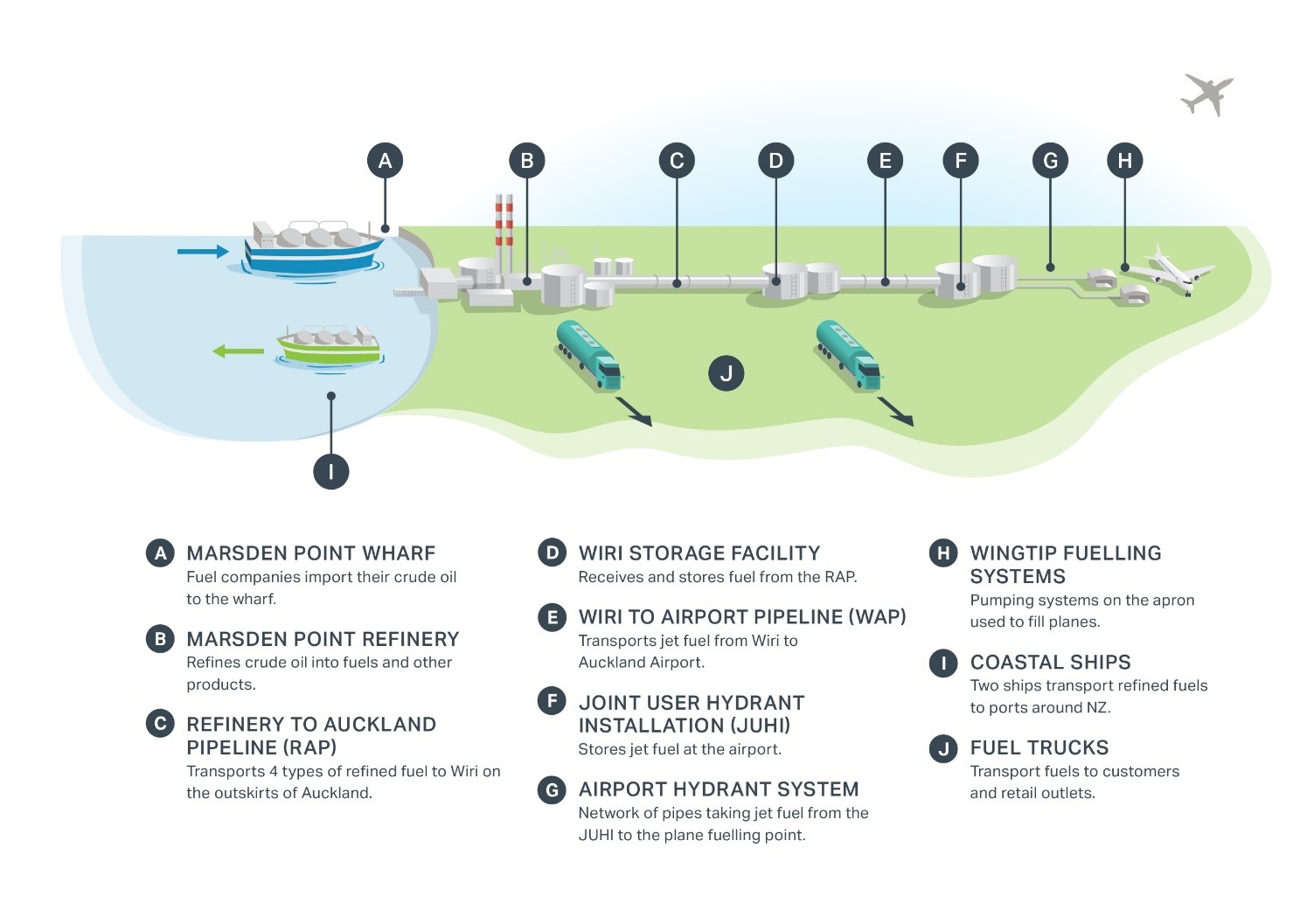

2.1 The main system for supplying all types of fuel to Auckland is shown in Figure 1. In summary:

- Ships bring crude oil to the wharf at Marsden Point, from either the New Zealand offshore oil fields or various overseas sources, where it is offloaded into storage tanks. Already-refined product is also sometimes brought into the wharf.

- The Marsden Point refinery processes the crude oil into several different products – two grades of petrol, diesel, jet fuel, marine fuel oil, sulphur, and bitumen.

- Petrol, diesel, and jet fuel (mainly for the Auckland region) are then sent down a 170-kilometre pipe to storage tanks at Wiri, on the outskirts of Auckland. It is a multi-product pipeline, so the different fuels are pumped one after the other in controlled batches. The interface of co-mingled product between each batch is separated and sorted on arrival at Wiri. The pipeline is called the Refinery to Auckland Pipeline,or RAP.[11]

- The different fuels are then stored in tanks at the Wiri facility, or “terminal”. Wiri only receives product from the RAP. It has no facilities for receiving product from trucks into its tanks.[12]

- Ground fuels (petrol and diesel) can be moved on immediately. At Wiri, they are loaded into trucks and taken to industry customers and retail petrol stations.

- Jet fuel is sent along another shorter pipeline – the Wiri to Airport Pipeline, or WAP – to storage tanks at Auckland Airport.[13] Jet fuel has very strict quality standards. Every time it has been moved, it must be left to “settle” for around 24 hours and then tested to ensure it meets the quality specifications.

- The airport storage tanks and underground hydrant pipeline systems are known as the Joint User Hydrant Installation (JUHI). The jet fuel must settle and be checked again at these tanks.

- The jet fuel is then transferred from the JUHI to the apron of the airport through the airport’s hydrant system, as well as by truck.

- Separate pumping systems on the apron take the fuel from the hydrant to the wingtip of the aeroplane.

2.2 A separate company, Gull NZ Ltd (Gull), also supplies ground fuels to Auckland through its own separate supply chain. It imports refined fuel from overseas to its storage tanks at Tauranga. From there, it trucks fuel to its retail outlets around the North Island, including to Auckland. BP and Mobil also bring imported high-octane petrol to Auckland from the Port of Tauranga. There are also some other smaller independent retailers.

Figure 1: The fuel supply chain for Auckland

The history of these assets and the petroleum sector[14]

2.3 The infrastructure making up this supply chain was built through a combination of public and private sector effort and investment, at a time when the petroleum sector was still heavily regulated. The following controls were placed on the sector:

- All wholesalers and retailers had to be licensed under the Industry Efficiency Act 1936. The Motor Spirits Licensing Authority issued site-specific retail licences, which were held in perpetuity.

- The Motor Spirits Distribution Act 1953 required separation between wholesalers and retailers.

- The Motor Spirits (Regulation of Prices) Act 1933 gave the Minister of Energy power to control the prices of all motor spirits by setting maximum and minimum prices. It allowed wholesalers a return of 13% on their assets.

- Each year a government committee negotiated set prices for crude oil, refined products, and freight and coastal shipping.

- The government set the refiner’s margin, based on a formula that allowed the refinery to recover its operating costs, depreciation, and a 12.5% net return on shareholder’s funds.

2.4 The result was that prices for the different fuel products were fixed a year in advance, with a single wholesale price at all ports and a single price at retail outlets.

2.5 By the late 1950s, the New Zealand government wanted the country to have its own refinery to save foreign currency, encourage the development of domestic industry, and give more fuel security. The international oil companies operating in New Zealand at the time were not interested initially, assessing the market as too small to support its own refinery. The government therefore needed to offer some inducements. These included helping to find a suitable site and offering the possibility of market protection.

2.6 In 1961, the New Zealand Refining Company Limited (Refining NZ) was created to build a refinery in in New Zealand. Its main shareholders were the five main fuel companies operating in New Zealand at the time (Shell, BP, Caltex, Europa, and Mobil). Between them, they held 68.57% of the shares, split according to their market shares at the time. The remaining shares were sold to the public and the company was listed on the New Zealand Stock Exchange. The company built the refinery at Marsden Point, which was commissioned in 1964.

2.7 In the 1970s, the Government approved several expansions to the refinery, because its production was not keeping up with growing demand. The international oil shocks of that decade were also causing concern. However, work did not start immediately, because neither the oil companies nor the government were keen to fund the expansions. In 1980, the Government agreed to give what was effectively a guarantee, allowing the necessary loans to be serviced through petrol pricing policies.

2.8 With this assistance, Refining NZ completed the expansion project in 1986, at a total cost of $1.848 billion. It included expansion of the refinery and construction of both the Wiri tank facility to store fuel close to Auckland and the RAP to transport refined fuel from the refinery at Marsden Point to Wiri. The pipeline to transport jet fuel from Wiri to Auckland Airport (the WAP) was built around the same time.

2.9 Across that same period in the 1980s, deregulation was being considered on the basis that exposing the industry to market forces would promote efficiency and lower prices. The main concerns were that the domestic market might not be large enough to sustain a fully competitive market and that the Marsden Point refinery (the only refinery in New Zealand) might need special support to survive if it was competing with imported refined products.

2.10 In 1986, the Government introduced arrangements to take over the debts from the construction of the “Think Big” projects, including the refinery. In 1988, the Government agreed to support the refinery after deregulation with a lump sum payment of $85 million spread over three years. That agreement enabled the Petroleum Sector Reform Act 1988 to be passed in May 1988. This Act removed all the previous controls over wholesale and retail activity.

2.11 The market is now fully deregulated and is controlled by the general laws governing all commercial activity in New Zealand. There are only two Acts specific to the petroleum industry in New Zealand: the International Energy Agreement Act 1976 and the Petroleum Demand Restraint Act 1981. Both date from the oil shocks of the 1970s and the significant international and domestic responses to these. Essentially, they make it possible to ration fuel in a crisis. Both Acts give the government significant powers to control the production, supply, and use of petroleum, but only if it has declared a petroleum emergency or shortage.[15]

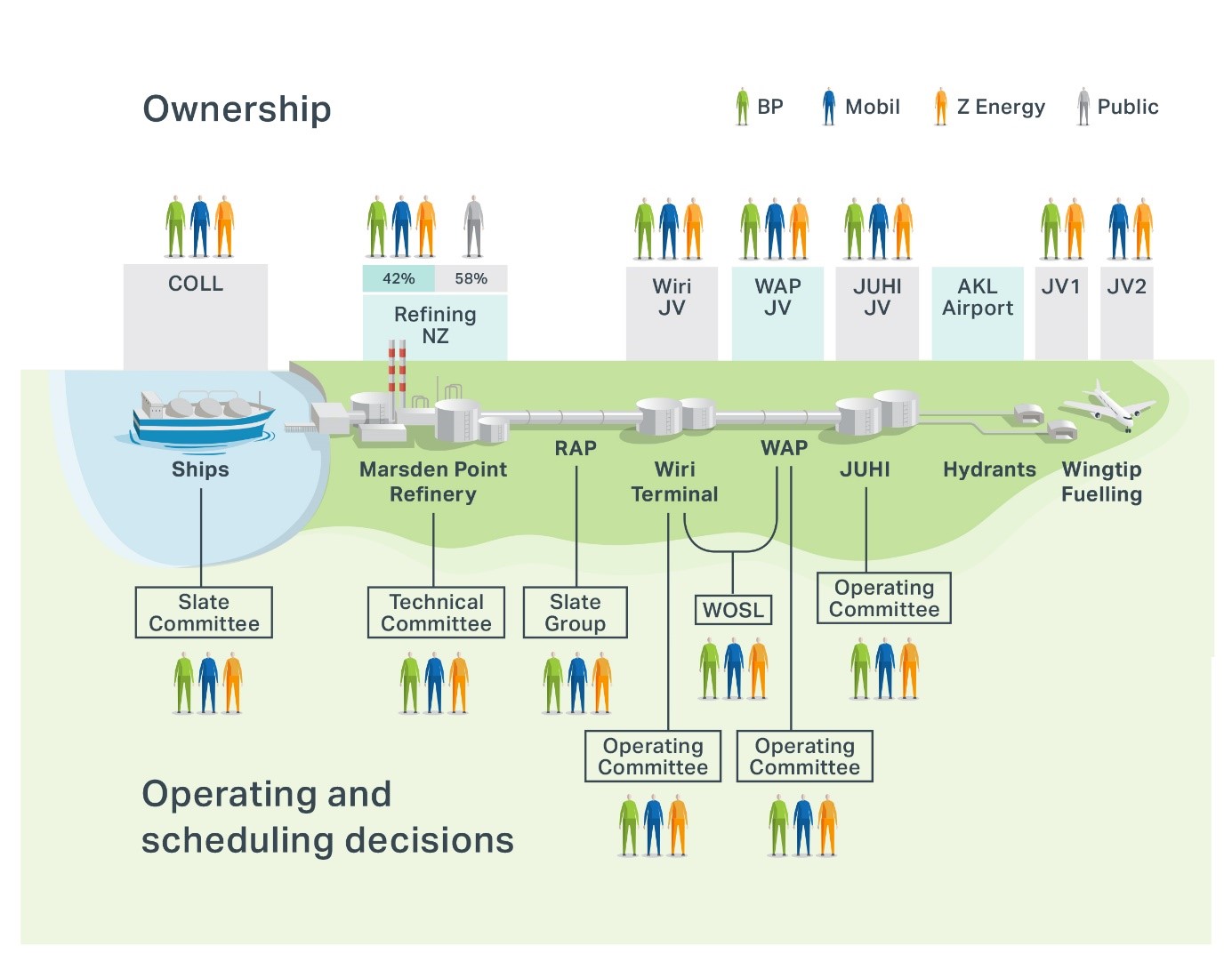

How the main Auckland fuel supply chain is now owned and operated[16]

Who owns what?

2.12 The infrastructure assets that make up the main Auckland fuel supply chain are owned by a number of different organisations, although the three major fuel companies[17] operating in New Zealand have substantial ownership interests in all of them. The ownership arrangements are summarised below and in Figure 2.

2.13 Throughout this supply chain, the fuel itself is owned by the fuel companies. The various facilities in the supply chain process store and move it for the fuel companies and charge fees for those services, but the facilities do not take ownership of the product itself.

2.14 Refining NZ is a publicly listed company. The majority of its shares are owned by institutional investors and other members of the public, but BP, Mobil, and Z Energy own 42% of its shares between them (as at 31 January 2019). They each have a seat on the board. Refining NZ owns and operates:

- the refinery at Marsden Point, including a wharf at which oil and other product tankers can berth; and

- the RAP.

2.15 The refinery is what is known as a “tolling” operation: the fuel companies that have their crude oil processed there and sent down the RAP pay a fee for the services. In principle, Refining NZ could process crude oil for any company, but in practice, the three shareholder fuel companies use all of its capacity.

2.16 At the refinery, a Technical Committee oversees optimisation and planning processes, including the allocation of capacity between the three fuel companies. It is made up of a representative from each fuel company and Refining NZ. It makes decisions by consensus.

2.17 A separate Slate Committee provides information to direct the scheduling, by Refining NZ, for fuel being sent down the RAP. It also comprises a representative from each fuel company, COLL, and Refining NZ. It makes decisions by majority.

2.18 At the other end of the RAP is the Wiri terminal. For historical reasons, the major fuel companies own the land and Refining NZ owns the terminal infrastructure (except for some later additions). The land is leased to Refining NZ and the land and terminal infrastructure is then leased back to the major fuel companies and to Wiri Oil Services Ltd (WOSL),a company that was set up to manage and operate the facility’s day-to-day activities.

2.19 WOSL is a private company. Its shares are owned by Mobil, BP, and Z Energy. WOSL is restricted to operating the facility exclusively for the benefit of these companies and is not authorised to discuss possible hosting or through-putting arrangements with other parties. Effectively, all decisions at shareholder and board meetings must be unanimous.

2.20 The three fuel companies own the WAP through a joint venture agreement. They make policy decisions about the WAP through an Operating Committee. WOSL manages the WAP on their behalf.

2.21 Auckland International Airport Ltd (Auckland Airport) owns the land at the airport where the JUHI is located. Auckland Airport is a publicly listed company.[18] It leases the JUHI site to the joint venture that runs the JUHI. The lease expires in 2035.

2.22 The JUHI joint venture owns the tanks and other infrastructure that make up the JUHI facility on the land leased from Auckland Airport. The participants in that joint venture are Mobil, BP, and Z Energy. An Operating Committee made up of all the participants makes all decisions, other than minor matters within the discretion of the operator. The three fuel companies used to take turns to operate the JUHI, but BP is now the long-term operator.

2.23 Auckland Airport owns the hydrant facilities that carry fuel from the JUHI tanks to the gates on the airport apron. Two further joint venture companies carry out the actual fuelling of aircraft “at the wingtip”. One is a joint venture between BP and Z Energy and the other is a joint venture between Mobil and Z Energy.

2.24 The other main parts of New Zealand’s fuel infrastructure relevant to Auckland are the two coastal tankers, a truck-loading facility at Marsden Point, and the trucks that transport fuel. These are part of the normal supply chain for diesel and marine fuel. They become more relevant to the supply of fuel to Auckland if there is a problem with the normal supply chain, as happened in 2017. Shipping services are provided by Coastal Oil Logistics Ltd (COLL), which is a private company owned by, and operated under, a joint venture agreement between the three fuel companies. Again, scheduling decisions are made by a Slate Scheduling Committee made up of representatives from each fuel company and COLL.

2.25 Each fuel company organises its own trucking services. They own some fuel trucks themselves and contract trucking companies for the remainder of their needs.

2.26 The combined effect of these ownership arrangements is that the major fuel companies own, control, or have exclusive rights to use this entire infrastructure at present. For the Wiri terminal, the WAP and the JUHI, the Inquiry was told that the norm is for all the companies to reach unanimous agreement before any commitment to investment in new or enhanced infrastructure is made.[19] Each company must go through its own internal decision-making processes before it can bring a position to the relevant decision-making body. If the three companies’ individual decisions do not align, there is further discussion and each company must go back through its own processes again. As a result, major decisions can take some time.

Figure 2: Ownership of the Auckland fuel supply chain infrastructure

Competition and cooperation

2.27 In economic terms, the supply chain is both:

- “vertically integrated”, meaning that the same companies own, control, or have exclusive rights to use all the parts of the supply chain, from importing oil, through processing, storage, and distribution, until the eventual sale of a product to a customer; and

- “horizontally coordinated”, because the ownership and joint venture arrangements at each point of the supply chain require the competing companies to work together.

2.28 This integration and coordination provides some benefits. Vertical integration means that the entire supply chain can quickly receive and respond to signals from consumers about demand or preferences. The horizontal coordination avoids duplication of expensive infrastructure, resulting in efficiency gains and cheaper prices for consumers.

2.29 In the absence of any sector-specific controls, the Commerce Act 1986 provides the main control on the activities of the fuel companies. This Act prohibits contracts, arrangements, or understandings that have the purpose or effect of:

- substantially lessening competition in a market;

- fixing prices;

- controlling supply; or

- allocating market share between participants in a market.

2.30 It also prevents a party from taking advantage of their market power to restrict entry to the market and prohibits resale price maintenance (controlling the price at which a supplier’s goods are on-sold).

2.31 This Act is an important control, given how intertwined the activities and assets of the three major fuel companies are, both in New Zealand and internationally. The companies manage their activities very carefully to ensure compliance with competition laws across all the countries in which they operate. In particular, they maintain strong limits on the information that can be communicated or shared with other parties, both because of the information’s commercial value to competitors and because of the need to avoid being perceived as collaborating and inhibiting effective competition.

2.32 The Commerce Commission oversees and enforces the Commerce Act. It has been carrying out a market study into the factors affecting the supply of retail petrol and diesel for land transport at the same time as this Inquiry has been carrying out its investigations. Its final report on that study is due in December 2019.

Capacity of the fuel supply chain

2.33 Around 120,000 tonnes of crude oil is delivered to the Marsden Point wharf on a roughly weekly basis, as well as a small amount of refined fuels. The wharf has the capacity to receive more vessels than currently use it.

2.34 The refinery processes crude oil into a number of products, including petrol, diesel, and jet fuel. These fuels are then sent in successive batches down the RAP to Wiri (although some are distributed by other means). Jet fuel requires its own facilities, such as storage tanks, valves, pumps, and trucks. Modifications are needed before infrastructure can be changed from ground fuels to jet fuel.

2.35 Assessing the capacity involves two different measures: storage volumes (the amount of fuel that can be stored at each location, shown in millions of litres) and throughput capacity (the rate at which fuel can be pumped through each pipe).

Ground fuels[20]

2.36 Table 1 shows the approximate capacity of the refinery, the RAP, and the Wiri terminal. Because the RAP transports several different types of fuel and the allocation of time to each can vary, it is hard to give a definitive figure for the capacity for a particular fuel. In this table, we simply give the throughput volume for that type of fuel in 2018.

Table 1: Capacity of the infrastructure: ground fuels

|

Facility |

Diesel |

Petrol (all grades) |

|---|---|---|

|

Refinery production |

2,150 million litres/year |

1,900 million litres/year |

|

Refinery: total available storage |

114 million litres |

142 million litres |

|

RAP throughput |

790 million litres/year |

967 million litres/year |

|

Wiri: total available storage[21] |

24 million litres |

56 million litres |

2.37 At Wiri, there are six loading bays for trucks to load petrol and diesel. Trucks can load up ground fuels across all six bays, at a maximum rate of approximately 360,000 litres per hour.

2.38 There are plans to introduce a drag-reducing agent to petrol and diesel, subject to a trial planned for later in 2019. This agent would increase the RAP throughput by about 15%, depending on the product mix. This will free up more time for jet fuel to be transported down the RAP.

Jet fuels[22]

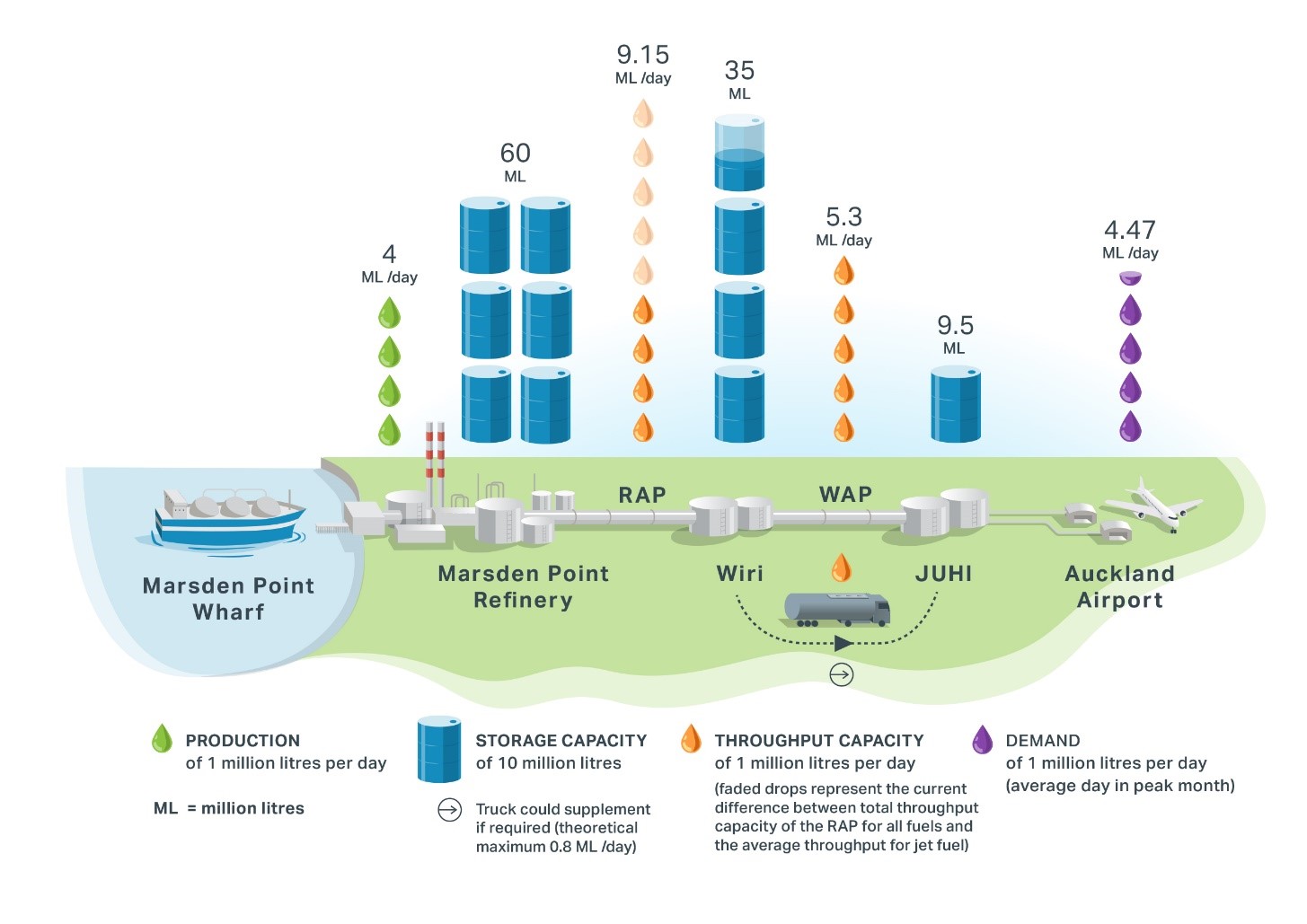

2.39 Figure 3 shows the current capacity across the different parts of the jet fuel supply chain.

Figure 3: Capacity of the infrastructure: jet fuel

2.40 The refinery currently produces approximately 3.9–4.4 million litres of jet fuel each day, which is about equal to its optimum production capacity. The fuel companies supplement jet fuel when needed by importing refined jet fuel into Marsden Point, which Refining NZ may process if the sulphur content is too high.[23]

2.41 The jet fuel storage tanks at the refinery have a total volume of approximately 60 million litres, including both finished product and “sour jet” that is yet to have sulphur removed. The refinery intends to convert an 18 million litre diesel tank to store jet fuel, to meet increasing demand.

2.42 The RAP has capacity to pump jet fuel at a rate of 9 million litres per day. At present, it typically pumps jet fuel for 14 days in a 31-day month, with the other days being used for ground fuels. As noted in paragraph 2.38, more time for jet fuel could become available if the pumping of ground fuels becomes more efficient – for example, by the introduction of a drag-reducing agent. This initiative follows on from several projects by Refining NZ to increase the RAP’s capacity.

2.43 The Wiri facility has three jet fuel tanks with a maximum capacity of 35 million litres and an average working stock of 17 million litres.

2.44 The WAP has a current maximum capacity of 5.3 million litres per day. It has plans to upgrade the automation at the JUHI to allow continuous pumping, which will slightly increase the capacity to approximately 5.5 million litres.

2.45 It would also be possible for trucks to take jet fuel from Wiri to the JUHI to supplement the WAP. This system is called a trucking “bridge”. This has not been necessary to date, but it is likely to be needed soon during periods of peak demand.[24] A recent test showed that trucks could transport approximately 800,000 litres per day. This test involved four trucks (eight drivers) running all day. This level of trucking would not be realistic for normal activity at the moment, given the disruption that trucks to the JUHI cause to traffic at the airport under its current configuration.

Back-up options and other supply routes

2.46 As the 2017 outage showed, this Auckland supply chain does not exist in isolation. When supply is disrupted, other parts of New Zealand’s overall fuel supply system become relevant.

2.47 For ground fuels, the fuel companies that usually send petrol and diesel down the RAP were able to load it onto ships at Marsden Point and transport it to Tauranga, the next closest port to Auckland with fuel tanks for receiving product from ships. From there, the fuels could be trucked to Auckland by diverting some of the fuel trucks operating in other parts of the North Island. It was possible to supply enough ground fuels through this alternative route to keep Auckland adequately supplied for the duration of the 2017 outage.

2.48 For jet fuel, which requires specialised tanks, trucks, and other facilities, there is no easy alternative supply route. The closest tanks capable of receiving jet fuel are in Wellington, but trucking jet fuel from Wellington would be time-consuming and would not provide the quantities needed (a jet fuel truck holds approximately 30,000 litres and it takes approximately 320,000 litres to fill an A380 aeroplane).

2.49 Therefore, during the 2017 outage, BP worked with the operators of Wynyard Wharf in Auckland, which had tanks that had been used for fuels before the RAP was built, to bring a shipload of jet fuel directly into that wharf. It took some time to obtain the necessary agreements and consents and to convert a tank back to jet fuel use, but that made it possible to truck 1.5 million litres of jet fuel from Wynyard Wharf to Auckland Airport. In addition, a small amount of jet fuel was trucked from Marsden Point.

2.50 The Wynyard Wharf route is no longer available, because the tanks at Wynyard Wharf are being removed as part of the redevelopment of the area for the America’s Cup in 2021. We have not been able to ascertain whether any consideration was given to the effect on Auckland’s emergency fuel supply options when the redevelopment decision was made.

2.51 In short, the 2017 RAP outage showed that there are proven alternative routes for bringing petrol and diesel to Auckland (trucking from Marsden Point and the Port of Tauranga) that could be scaled up if needed. However, there is no effective alternative way of bringing significant quantities of jet fuel to Auckland.

3. What is resilience?

3.1 The purpose of this Inquiry was to draw lessons from the RAP outage to inform how the fuel industry and the Government could improve the resilience of fuel supply in the Auckland region. That required us to assess the resilience of the current fuel supply system.

3.2 In this chapter, we explain how we considered and defined resilience and the tools we used to assess it.

Defining resilience

3.3 Our approach to the concept of resilience was informed by the following comment from The Thirty Year New Zealand Infrastructure Plan 2015:

Our asset management practices also need to include a stronger understanding of the resilience of our infrastructure networks at a national, regional and local level, especially key pinch-points and the degree to which different parts of networks are critical to overall performance. There is a need to increase the sophistication of how we think about resilience, shifting beyond a narrow focus on shock events or infrastructure failure and thinking more about interdependencies, levels of service and community preparedness.[25]

3.4 There are many definitions of resilience. The two that we found most helpful were those used by the Ministry of Civil Defence and Emergency Management (MCDEM) in its National Disaster Resilience Strategy and the Rockefeller Foundation in its 100 Resilient Cities programme:

Resilience is the ability to anticipate and resist disruptive events, minimise adverse impacts, respond effectively, maintain or recover functionality, and adapt in a way that allows for learning and thriving. In essence, it’s about developing a wide zone of tolerance – the ability to remain effective across a range of future conditions.[26]

and

100RC defines urban resilience as the capacity of individuals, communities, institutions, businesses, and systems within a city to survive, adapt, and grow no matter what kinds of chronic stresses and acute shocks they experience.[27]

3.5 Each definition highlights a different aspect of the concept:

- The MCDEM definition encompasses all the different stages of activity that make up a resilient system: planning and preparation, prevention, immediate response, recovery, and adaptation and learning.

- The Rockefeller Foundation definition specifically covers both acute shocks (sudden, sharp, disruptive events like earthquakes) and chronic stresses (gradual changes that weaken a system, like climate change).

- Both definitions specifically extend beyond just managing and recovering from problems to include adapting, growing, learning, and thriving.

3.6 We considered all these aspects were relevant when considering Auckland’s fuel supply system. This meant that our assessment of overall resilience looked at:

- prevention;

- planning and preparation, as well as response;

- the ability of the system to deal with both acute shocks, such as the sudden rupture of the RAP, and more gradual stresses, such as the increasing demand for jet fuel;

- whether we could see evidence of a system that learns from experience; and

- whether the system was aiming to provide a platform for the region to grow and thrive.

The qualities of a resilient system

3.7 The Inquiry has summarised the qualities that a resilient system should have in Table 2. This summary draws on the framework developed by the Rockefeller Foundation and Arup International Development in the 100 Resilient Cities programme.[28]

Table 2: Qualities of resilient systems

|

Learning from the past and acting in times of crisis |

Reflectiveness |

The ability to learn from past experiences to inform future decision making and to modify standards and behaviours accordingly. |

|

Resourcefulness |

The ability to recognise alternative ways of using resources to meet people’s needs during a shock or when under stress, which may include investing in capacity to anticipate future conditions. |

|

|

Designing systems and assets that can withstand shocks and stresses |

Robustness |

Robust systems have infrastructure that is well conceived, well constructed, and well managed to withstand the impacts of events without sustaining significant damage or loss of function. This includes making provision to ensure that failure is predictable, safe, and not disproportionate to the cause of that failure. |

|

Redundancy |

Spare capacity is created intentionally to accommodate disruption due to extreme pressures, surges in demand, or an external event. Redundancy includes diversity (i.e., the presence of multiple ways to fulfil a function). |

|

|

Flexibility |

The ability to adopt alternative strategies in response to changing circumstances or sudden crises. |

|

|

Good governance and effective leadership that ensure investments and actions are appropriate |

Inclusiveness |

Inclusiveness emphasises the need for broad consultation and the engagement of communities to create a sense of shared ownership or a joint vision to build resilience. |

|

Integration |

Integration brings together systems and institutions, promoting consistent decision making and ensuring that investments in systems are mutually supportive to achieve a common goal. |

3.8 During the Inquiry, the participants identified various mechanisms that enhance the resilience of a fuel supply chain. Many of these mechanisms reflect these qualities of resilient systems. For example, participants pointed to:

- identifying hazards and risk, and putting in place regulations, procedures, and mechanisms to prevent these from occurring;

- being prepared for an event by having contingency or business continuity plans that are practised regularly, and having the people, equipment, and means to execute these plans;

- adapting existing infrastructure and methodologies in response to lessons from events;

- increasing capacity of existing infrastructure, both for redundancy and to keep up with demand and future growth;

- having enough fuel storage in the system to reduce the impact of the disruption;

- having alternative methods of supply that can be deployed or scaled up in a fuel disruption; and

- holding sector-wide forums to identify future infrastructure requirements and coordinate investment planning.

The attributes of a resilient fuel supply system

3.9 The Inquiry engaged Fueltrac Pty Ltd (Fueltrac), an Australian-based consultancy firm with expertise in fuel supply systems, to:

- assess both the current resilience and reasonably expected future resilience of the infrastructure making up the fuel supply chain for Auckland; and

- recommend options to improve its resilience.

3.10 Fueltrac used the standards shown in Table 3 to carry out its assessment. It has previously used these standards with the Australian Government to assess the resilience of the fuel supply chain in various locations in Australia. These standards focus on system resilience qualities such as resourcefulness, robustness, redundancy, and flexibility.

Table 3: Fueltrac’s resilience standards for assessing fuel security

|

Ground & jet fuels |

Diversity of supply |

This standard identifies whether there are at least two fuel supply chains from port to market. In the event of an unplanned disruption in the primary supply chain, the alternative supply chains should be capable of supplying a large portion of the market. |

|

Days’ total cover (in seaboard storage and close to market) vs resupply time |

This standard measures whether the amount of fuel in storage is sufficient to meet the resupply time from a flexible international supply chain. |

|

|

Jet fuel only |

Storage close to market (Wiri and Auckland Airport) |

This standard measures the capability of the market to accommodate an upstream disruption in jet fuel supply. |

|

Input supply capacity vs peak days’ demand (Auckland Airport) |

This standard measures the capability of the supply mechanisms to meet peak demand while still allowing some capacity to cope with short-term shutdowns or delays. Specifically, the combined input capacity to the JUHI from pipeline and trucking bridges should exceed 110% of the peak days’ jet fuel demand. |

3.11 During the Inquiry, some participants submitted that there was a conceptual difference between resilience and fuel security, with fuel security being concerned with reliability of supply (including considerations such as cost-effectiveness, usefulness, timeliness, efficiency, and safety). However, the Inquiry considered that fuel security fell within its definitions of resilience.

3.12 In applying these resilience standards, we focused on the forecasts of demand for fuel through until 2030. Although the forecasts we used looked out to 2040 or more, we considered that the data became less reliable beyond about 2030.

3.13 The application of these resilience standards to the Auckland region’s supply chain is discussed in detail in Parts D and E of this report.

Where does a cost-benefit analysis fit in?

3.14 Many parties suggested to the Inquiry that we should be carrying out detailed cost-benefit work before making any recommendations for change. The Inquiry’s terms of reference were silent on this point.[29]

3.15 The Inquiry reviewed the previous reports on fuel security commissioned by MBIE and its predecessors, which have assessed the costs and benefits of different options for additional infrastructure.[30] We also had the benefit of considering the May 2019 report prepared for MBIE by Market Economics, Economics of Fuel Supply Disruptions and Mitigations.[31] This report evaluated the economic consequences of five fuel outage scenarios[32] and the extent to which different quantities of additional fuel storage would mitigate the economic losses.

3.16 The authors of that report sounded a note of caution about how this type of work should be used:

In CBA [cost-benefit analysis] studies, uncertain benefits (or costs) are often quantified simply as the expected monetary value – the calculated monetary benefits under each contingency, multiplied by the probability of that contingency occurring. The major difficulty with this approach, however, is that it does not account for people’s risk aversion. There is ample evidence that in risky situations, many individuals will be willing to pay more than expected monetary benefits to avoid an adverse situation. The difference between the expected monetary benefits and willingness-to-pay is often termed the ‘risk premium’.[33]

3.17 The report noted the complexity of trying to determine an appropriate “social risk premium”, especially in relation to disruption events. It concluded that the main contributions of scenario-based economic impact analyses are to:

- reduce uncertainty by helping to explore the causes, effects, and potential outcomes of disruption events; and

- provide a common focus for debate on the appropriate level of societal investment in mitigation steps.

3.18 This Inquiry is a first step in a longer process. Our role was to provide an independent assessment of the current situation and recommend directions for change.

3.19 If the Government accepts our recommendation that they should develop legislative proposals to create regulatory options for the fuel industry, then the policy development process will include a full assessment of the costs and benefits of the various regulatory options in the normal manner.[34] The results of that assessment would be published to inform debate once a Bill is introduced to Parliament.

3.20 The fuel supply market in New Zealand is fully deregulated and controlled by the general laws governing all commercial activity in New Zealand. We acknowledge that until this Inquiry, the industry participants had not been thinking of resilience of the overall supply chain against a set of minimum resilience standards. For the reasons that we explain in chapter 18, it will be up to these industry participants to carry out a cost-benefit analysis of their own individual investment opportunities in the usual way, taking into account the Inquiry’s minimum resilience standards.

3.21 We decided that it was not necessary or useful for the Inquiry to attempt to carry out that cost-benefit work itself, either in relation to possible legislative options or potential investments in particular infrastructure.

PREVIOUS | NEXT | Return to CONTENTS

[1] The allocation was raised to 50% on Friday 22 September, 80% on Monday 25 September, and then returned to 100% on Saturday 30 September.

[2] See the discussion in chapter 11.

[3] The full terms of reference are set out in Appendix A.

[4] New Zealand Lifelines Council, NZ Lifelines Infrastructure Vulnerability Assessment: Stage 1, September 2017, p 5.

[5] New Zealand Government, The Thirty Year New Zealand Infrastructure Plan 2015, p 25.

[6] Market Economics Research, Economics of Fuel Supply Disruptions and Mitigations, May 2019.

[7] See chapter 11.

[8] See Minutes 1 and 2, available at https://www.dia.govt.nz/Auckland-Fuel-Line---Useful-information.

[9] See Minutes 1, 2, 3, and 5, available at https://www.dia.govt.nz/Auckland-Fuel-Line---Useful-information.

[10] See Minute 5.

[11] Fuel going to other parts of the country is sent by truck if it is going to Northland or shipped on two coastal tankers to other ports around New Zealand.

[12] Z Energy also has a biofuels storage facility at Wiri.

[13] Some jet fuel is also sent by truck to regional airports.

[14] This history primarily draws on Pickford & Wheeler, The Petrol Industry: Deregulation, Entry and Competition, NZ Trade Consortium Working Paper No. 12, 2001.

[15] Appendix C sets out a brief description of the main legislation relevant to the petroleum sector.

[16] A comprehensive description of the ownership and operating arrangements from 2016 can be found in Z Energy Ltd and Chevron New Zealand [2016] NZCC 10.

[17] There are effectively three major fuel companies in New Zealand: BP, Z Energy, and Mobil. Z Energy has a subsidiary company, Z Energy 2015 Ltd, which was formed as part of the process for Z Energy taking over Chevron in 2015–16. It owns some of the assets previously owned by Chevron, including the Caltex brand. For the Inquiry’s purposes, we treated the two Z Energy companies as a single group.

[18] Its largest shareholder is Auckland Council, which owns 22%.

[19] There is a mechanism in the various agreements between them for investments to proceed when not all the parties agree, but the Inquiry was told that this has only been used once to date, when Z Energy invested in facilities to support biofuels.

[20] The base data we used in this section was sourced from information given to the Inquiry by Refining NZ and WOSL. We have converted all figures to millions of litres, for consistency.

[21] Total available storage refers to the volume of the storage tanks available at the site. Average working stock is the average amount of fuel available for use at any one time.

[22] The base data in this section is sourced from information provided by Refining NZ, WOSL, and Fueltrac.

[23] It removes the sulphur so that the jet fuel can be sent down the multi-product RAP without creating problems for other fuels, particularly diesel. Jet fuel that includes sulphur can be used in aircraft without any problems.

[24] See interview with WOSL of 24 April 2019, and response from Z Energy to Inquiry’s questions of 12 April 2019.

[25] New Zealand Government, The Thirty Year New Zealand Infrastructure Plan 2015, p 47.

[26] MCDEM, National Disaster Resilience Strategy – Rautaki ā-Motu Manawaroa Aituā (April 2019), p 2.

[27] http://www.100resilientcities.org/resources/, accessed 8 July 2019.

[28] These qualities have been taken from two versions of the Rockefeller Foundation and Arup City Resilience Framework – 100 Resilient Cities (published in April 2014 and November 2015).

[29] In fact, a requirement to carry out a cost benefit analysis in an earlier draft was removed, to reduce the timeframe for the Inquiry). See Cabinet Paper Government Inquiry into the Auckland Fuel Supply Disruption: Terms of Reference and Financial Implications (November 2018), para 29. This Cabinet paper is accessible on the Inquiry’s website: https://www.dia.govt.nz/Auckland-Fuel-Line---About-the-Inquiry.

[30] See, for example, Hale & Twomey, New Zealand Petroleum Supply Security 2017 Update, September 2017; and the three reports that made up the 2012 Oil Security Review. These are all available at https://www.mbie.govt.nz/building-and-energy/energy-and-natural-resources/energy-generation-and-markets/liquid-fuel-market/oil-security-in-new-zealand/#oilsecurity, accessed on 7 August 2019.

[31] Market Economics, Economics of Fuel Supply Disruptions and Mitigations (Final Report, 24 May 2019).

[32] These scenarios are: (1) an international fuel disruption; (2) long-term refinery outage; (3) short-term refinery outage; (4) long-term disruption to the RAP/Wiri; and (5) short-term disruption to the RAP/Wiri.

[33] Market Economics, Economics of Fuel Supply Disruptions and Mitigations (Final Report, 24 May 2019), p 11.

[34] See Cabinet Office, CabGuide, “Impact analysis and regulatory impact assessments”, November 2017, available at https://dpmc.govt.nz/publications/impact-analysis-and-regulatory-impact-assessments; and https://treasury.govt.nz/publications/guide/guide-cabinets-impact-analysis-requirements-html, accessed 7 August 2019