Part D: Ground fuels – infrastructure

PREVIOUS | NEXT | Return to CONTENTS

13. How resilient is the supply system for ground fuels?

13.1 In this Part, we assess the resilience of the system for bringing ground fuels to Auckland. Most of the ground fuels for Auckland are received at, and distributed from, the storage tanks at Wiri. The three major fuel companies provided us with a copy of a recent report prepared by Hale & Twomey for WOSL, that assesses the resilience of the supply chain: Auckland and Auckland Airport Product Supply Chain Resilience – 2019 update (the “2019 WOSL Report”).This report contains a detailed assessment of the Wiri terminal’s capacity in relation to ground fuels.

13.2 The Inquiry also asked Fueltrac to assess the resilience of the ground fuels supply chain for Auckland. It did this by using two standards:

- diversity of supply routes; and

- a comparison of the number of days of cover provided by storage in the supply chain (days’ cover) with the time it would take to bring in supplies from elsewhere (resupply time).

13.3 This chapter summarises the results of that analysis alongside the additional data we received from the fuel companies and others.

The different routes for bringing ground fuels to Auckland

13.4 The main supply chain is the one described in chapter 2: diesel and the various grades of petrol are refined at Marsden Point, sent down the RAP to Wiri, and then distributed to Auckland-based customers and retail service stations by truck. However, there are also several other possible routes for these fuels. They can be:

- loaded onto trucks at the truck-loading facility outside the refinery at Marsden Point, and then brought to Auckland and delivered by truck;

- loaded onto a coastal ship at Marsden Point, shipped to a bulk-storage terminal at Mount Maunganui, and then brought to Auckland by truck;

- imported as already-refined product to the bulk-storage terminal at Mount Maunganui and brought to Auckland by truck; or

- trucked to Auckland from a bulk-storage terminal in New Plymouth.

13.5 Diesel can also be shipped to the storage tanks at Wynyard Wharf and then distributed around Auckland by truck. There are no petrol tanks at Wynyard Wharf.

13.6 Ground fuels are usually transported by truck around New Zealand. As a result, it is easier to create alternative supply routes for these when something goes wrong with the normal supply chain. Reasonable numbers of trucks and drivers are likely to be available to truck fuel on a new route.[1]

13.7 The 2017 RAP outage showed this to be the case for Auckland. The usual main supply chain could not operate, but because there were alternative ways to supply the Auckland region, there was no need to ration fuel during the 10-day outage.

13.8 Towards the end of the outage period, both Mobil and Z Energy ran out of premium-grade petrol for some of their Auckland service stations. There was no premium-grade petrol left at the Wiri terminal. If the outage had been longer, shortages in regular petrol and diesel would have been likely. We also note that if the Wiri terminal should become inoperable for a significant period, rationing of ground fuels within Auckland would be likely.

13.9 Fueltrac agreed that a number of independent storage terminals for ground fuels are available around the North Island and there are more than two ways of transporting petrol and diesel products.We agree with their assessment that there is good diversity of supply for ground fuels.

The days of cover provided by the storage in the supply chain

13.10 The number of days of cover in any supply chain varies across the supply cycle, because storage levels will be high when tanks have just been refilled and low when they are just about to be refilled.[2] Fueltrac calculated that there is approximately 12 days’ cover for normal consumption of diesel and petrol at the low point of the supply cycle, rising to 17 days’ cover at the high point of the cycle.[3]

13.11 Fueltrac then set this figure against the time it would take to bring fuel in from somewhere else, to replenish supplies for the region. They assessed the best-case resupply time at 14 days, based on a scenario in which refined fuel that had been imported to Australia was redirected to Marsden Point wharf. [4]

13.12 These are not exact calculations as they involve several assumptions. However, the comparison gives a useful indication of how well the region would manage with existing stocks until new supplies could be brought in. Fueltrac calculated that days’ cover for ground fuels at the low point of the supply cycle falls two days short of the best-case resupply time. However, the disruption risk is reduced because there is a second supply chain that imports fuel directly into Tauranga and can be scaled up if needed.

13.13 Based on this analysis, Fueltrac was satisfied with the resilience of the ground fuels supply chain for Auckland for petrol of all grades. They noted that resilience would be reduced for diesel following the removal of the tanks at Wynyard Wharf. We discuss this further in paragraph 13.22.

Petrol storage at Wiri

13.14 Hale & Twomey identified that, despite a small growth in national demand for petrol over the past three years (+3%), there has been a decline in petrol throughput at the Wiri terminal (−13%).[5] They cited three reasons for this change:[6]

- In 2016 and 2017, the RAP reached capacity following sharp jet fuel growth, resulting in a shift of petrol products to other terminals.

- The 2017 RAP outage resulted in a need to shift substantial petrol demand to other terminals, some of which did not shift back to the Wiri terminal.

- The Auckland regional fuel tax, which was implemented in July 2018, has reduced throughput at the Wiri terminal.

13.15 Despite the small growth in petrol demand nationally, Refining NZ and the fuel suppliers told the Inquiry that they expected petrol demand to be reasonably flat across the coming decade, especially in light of the New Zealand Government’s intention to become carbon neutral by 2050.

13.16 As a result, the storage at Wiri terminal is likely to be sufficient to manage demand for petrol through to at least 2030. There is also storage available at other points in the supply chain, including Marsden Point and Mount Maunganui.

Storage capacity for diesel

Wiri

13.17 The picture is different in relation to diesel. Nationally, the demand for diesel has been growing at an average rate of about 13% over the past three years. The demand at Wiri over this period has increased at the lower rate of 7%.[7]

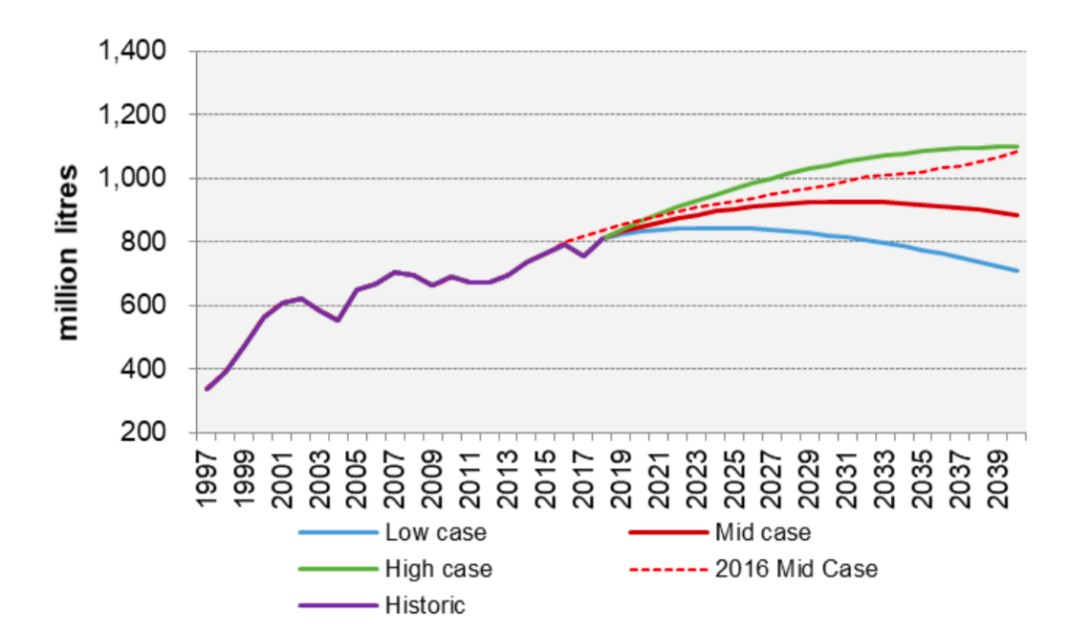

13.18 Figure 9 shows the forecast diesel demand at Wiri through to 2040, based on low, mid and high case forecasts. The Inquiry focused on the forecasts through to 2030. These show that the throughput demand for diesel is expected to keep increasing through to 2030 on the mid and high forecasts.

Figure 9: Forecasted diesel demand scenarios at Wiri to 2040[8]

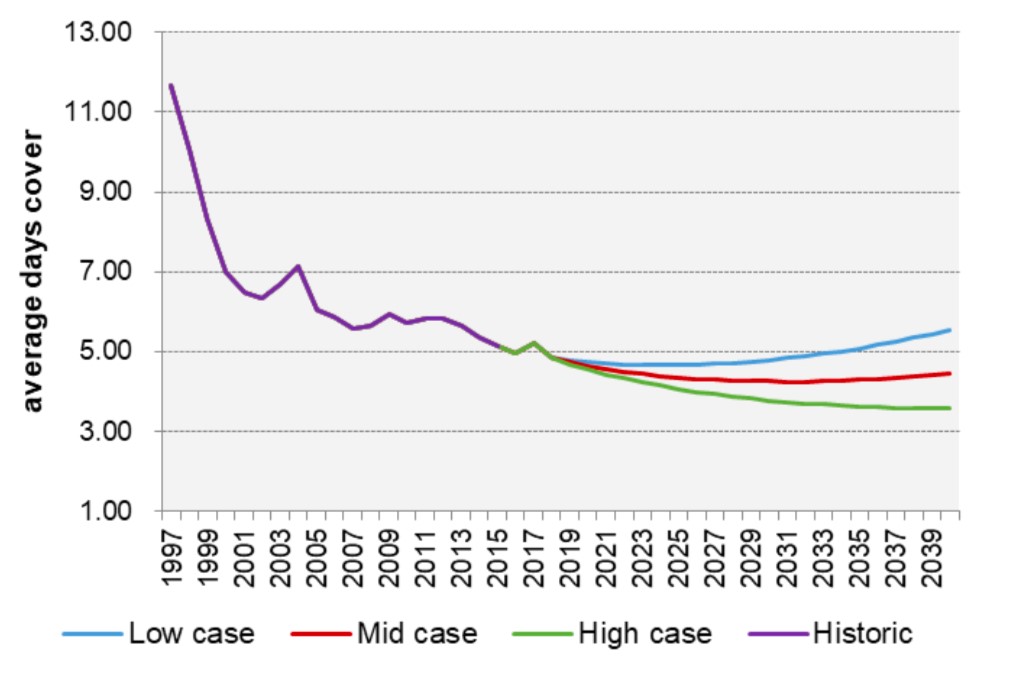

13.19 If demand increases and storage stays the same, the number of days’ cover the storage facility can provide for that fuel will gradually decrease. Figure 10 shows the reduction in days’ cover for diesel at the Wiri terminal:

- Cover drops from seven days in the mid-2000s to about five days in 2019.

- On the mid forecast, cover drops to four days by 2030.

- On the high forecast, cover drops to close to three days by 2030.

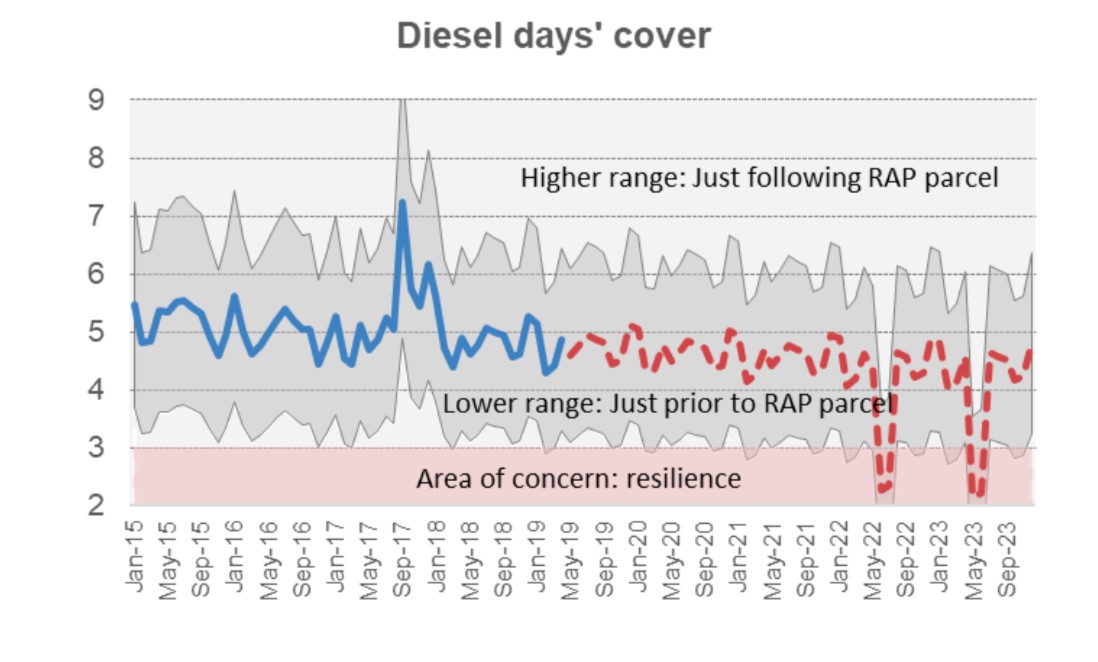

13.20 Hale & Twomey also noted that days’ cover was currently dropping to close to three days just before a new batch of diesel is delivered down the RAP, and was expected to fall below that level in the near future. They regarded stocks below the three-day level as a concern from a resilience perspective.[9] We note that the two sharp drops shown in Figure 11 are periods when a diesel tank will be offline for necessary 10-year maintenance.

13.21 However, the picture is complicated by the likelihood that ground fuels will gradually be displaced from the RAP so that it can transport more jet fuel. If that happens, ground fuels will be brought in through other routes, so the Wiri storage may become less important.

Figure 10: Diesel days’ cover at Wiri through to 2040[10]

Figure 11: Diesel days’ cover at Wiri in the medium term[11]

Wynyard Wharf

13.22 Wynyard Wharf currently has two tanks, with capacity to store 13 million litres of diesel in total. However, these tanks are due to be decommissioned and removed from 2020. Several participants identified that the removal of these tanks will create a resilience issue in relation to diesel. BP stressed that the Wynyard Wharf tanks were very helpful in managing supply during the RAP outage. Stolthaven Terminals, which operates the Wynyard Wharf facility, told us that during the outage:

- Stolthaven immediately increased diesel distribution and extended operating hours to 24 hours, seven days a week;

- Wynyard Wharf received 17 million litres of diesel from two ships;

- Wynyard Wharf distributed 12 million litres of diesel product over September and October 2017, (involving 820 truck movements); and

- diesel capacity at Wynyard Wharf continued to support Wiri for several months after the pipeline outage, because it took some time for the storage at Wiri to return to normal levels while the RAP was run at lower pressure.

13.23 To make up for the loss of 13 million litres of diesel storage at Wynyard Wharf, Fueltrac concluded that investment in additional diesel tank storage in other parts of the supply chain is required.

13.24 In our view, the combination of the loss of storage capacity at Wynyard Wharf and the reduced cover that is expected at Wiri means the system for supplying diesel is losing resilience. Further investment in storage may be needed soon, but the amount and location will depend on the way the supply chains develop over the next few years. Given the lead time for making decisions and building storage tanks, we consider that the fuel companies need to monitor the situation closely so they can make decisions in a timely way.

Our findings on the supply system for ground fuels

13.25 We have concluded that the systems for supplying the Auckland region with petrol of all grades are sufficiently resilient now and through to 2030, because:

- there are several permanent routes or supply chains for bringing petrol into Auckland, which can be scaled up as needed if there is a problem with the main supply route; and

- the main storage facility at Wiri has sufficient storage capacity to manage the expected demand for petrol.

13.26 The 2017 outage proved the resilience of the supply systems for petrol. The only shortage was that a small number of retail outlets ran out of higher-grade petrol in the last few days of the outage.

13.27 The system for supplying diesel has the same diversity of supply chain options, which is a strength. However, the demand for diesel is projected to increase through to 2030 and the storage capacity at Wynyard Wharf will be lost from 2020. The capacity to manage at the Wiri terminal is forecast to decline, with days’ cover projected to drop to below three days at the low point of the supply cycle more often.

13.28 These forecasts show that the level of resilience for diesel is decreasing. In our view, this decreasing resilience for diesel needs to be monitored closely to ensure the decisions regarding the required investment in additional storage can be made in a timely way. The location and size of any new storage will depend on the use of the different supply routes.

Our recommendation on ground fuels

Recommendation 14: Auckland needs additional storage tanks for diesel

We recommend that the fuel companies:

- closely monitor the resilience of the arrangements for supplying diesel to Auckland; and

- give early consideration to the investment in new storage tanks that will be needed to maintain an appropriate level of resilience, while recognising the multiple supply chain routes to the Auckland region.

PREVIOUS | NEXT | Return to CONTENTS

[1] BP Response to Information Request, para 1.3.3.

[2] Low points can occur for several reasons: for example, coastal tankers may have just been loaded to take supplies to other ports; international shipping may be delayed because of weather or berth congestion; there may be a short-term refinery outage; or a tank may be out of service. In general, these situations are anticipated and managed as part of ordinary activity.

[3] Fueltrac’s assessment excluded the diesel storage at Wynyard Wharf, given that these tanks are to be decommissioned in the near future.

[4] Resupply time is estimated using the assumptions of a flexible international supply chain; a buyer prepared to pay a premium to secure an option; an exchange; and a supply diversion or another trading option to facilitate prompt deliveries of liquid fuels. Fueltrac, Options to achieve better resilience and security of fuel supply for Auckland, in particular for jet fuel (June 2019), p 24.

[5] Hale & Twomey, Auckland and Auckland Airport Product Supply Chain Resilience – 2019 update (May 2019), (the 2019 WOSL Report), p 9.

[6] 2019 WOSL report, p 9.

[7] 2019 WOSL Report, p 11.

[8] 2019 WOSL Report, p 12.

[9] 2019 WOSL Report, p 16.

[10] 2019 WOSL Report, p 16.

[11] 2019 WOSL Report, p 16.