Archived Result 10 measurements (Archived)

This page has been archived

The Government announced in January 2018 that the Better Public Services programme would not continue in this form. These pages have been archived.

- July-September 2016

- April-June 2016

- January-March 2016

- October-December 2015

- July-September 2015

- April-June 2015

- January-March 2015

- October-December 2014

- July-September 2014

- April-June 2014

- January-March 2014

- October-December 2013

- July-September 2013

- April-June 2013

- January-March 2013

- October-December 2012

- July-September 2012

Quarterly Measures - for July-September 2016

|

Agency |

Service |

Jul-Sep 2015 |

Apr-Jun 2016 |

Jul-Sep 2016 |

|---|---|---|---|---|

|

Department of Conservation |

Book Department of Conservation Asset |

30.4% |

24.6% |

29.8% |

|

NZ Customs Service |

SmartGate |

51.9% |

61.1% |

60.6% |

|

Ministry of Business, Innovation & Employment (Immigration NZ) |

Apply for Visa |

20.6% |

21.1% |

30.0% |

|

New Zealand Transport Agency |

Pay for Vehicle Licence |

32.9% |

36.7% |

36.6% |

|

New Zealand Police |

Pay for Fine |

56.4% |

60.9% |

62.8% |

|

Inland Revenue |

File an Individual Tax Return |

84.4% |

87.7% |

86.9% |

|

Pay Individual Tax |

86.0% |

84.1% |

89.4% |

|

|

Apply for an IRD Number |

20.9% |

26.7% |

26.3% |

|

|

Ministry of Social Development |

Apply for Financial Assistance (1) |

39.7% |

46.8% |

47.9% |

|

Department of Internal Affairs |

Renew Adult Passport (2) |

43.7% |

47.1% |

48.8% |

|

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

46.7% |

52.2% |

51.9% |

|

(1) A change in reporting methodology for the transaction Apply for Financial Assistance came into effect during October-December 2013. It resulted in a decrease in the digital uptake of this transaction across all periods.

(2) The figures shown for Renew Adult Passport are estimated.

Quarterly Measures - for April-June 2016

|

Agency |

Service |

Apr-Jun 2015 |

Jan-Mar 2016 |

Apr-Jun 2016 |

|---|---|---|---|---|

|

Department of Conservation |

Book Department of Conservation Asset |

23.3% |

40.8% |

24.6% |

|

NZ Customs Service |

SmartGate |

54.6% |

57.2% |

61.1% |

|

Ministry of Business, Innovation & Employment (Immigration NZ) |

Apply for Visa |

9.2% |

20.4% |

21.1% |

|

New Zealand Transport Agency |

Pay for Vehicle Licence |

34.9% |

32.6% |

36.7% |

|

New Zealand Police |

Pay for Fine |

54.9% |

59.3% |

60.9% |

|

Inland Revenue |

File an Individual Tax Return |

91.3% |

94.3% |

87.7% |

|

Pay Individual Tax |

80.3% |

83.7% |

84.1% |

|

|

Apply for an IRD Number |

21.5% |

24.0% |

26.7% |

|

|

Ministry of Social Development |

Apply for Financial Assistance (1) |

37.8% |

60.9% |

46.8% |

|

Department of Internal Affairs |

Renew Adult Passport (2) |

45.0% |

48.9% |

47.1% |

|

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

45.3% |

52.2% |

49.7% |

|

(1) A change in reporting methodology for the transaction Apply for Financial Assistance came into effect during October-December 2013. It resulted in a decrease in the digital uptake of this transaction across all periods.

(2) The figures shown for Renew Adult Passport are estimated.

|

Agency |

Service |

Apr-Jun 2015 |

Jan-Mar 2016 |

Apr-Jun 2016 |

|---|---|---|---|---|

|

Department of Conservation |

Book Department of Conservation Asset |

23.3% |

40.8% |

24.6% |

|

NZ Customs Service |

SmartGate |

54.6% |

57.2% |

61.1% |

|

Ministry of Business, Innovation & Employment (Immigration NZ) |

Apply for Visa |

9.2% |

20.4% |

21.1% |

|

New Zealand Transport Agency |

Pay for Vehicle Licence |

34.9% |

32.6% |

36.7% |

|

New Zealand Police |

Pay for Fine |

54.9% |

59.3% |

60.9% |

|

Inland Revenue |

File an Individual Tax Return |

91.3% |

94.3% |

87.7% |

|

Pay Individual Tax |

80.3% |

83.7% |

84.1% |

|

|

Apply for an IRD Number |

21.5% |

24.0% |

26.7% |

|

|

Ministry of Social Development |

Apply for Financial Assistance (1) |

37.8% |

60.9% |

46.8% |

|

Department of Internal Affairs |

Renew Adult Passport (2) |

45.0% |

48.9% |

47.1% |

|

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

45.3% |

52.2% |

49.7% |

|

(1) A change in reporting methodology for the transaction Apply for Financial Assistance came into effect during October-December 2013. It resulted in a decrease in the digital uptake of this transaction across all periods.

(2) The figures shown for Renew Adult Passport are estimated.

|

Agency |

Service |

Oct-Dec 2014 |

Jul-Sep 2015 |

Oct-Dec 2015 |

|---|---|---|---|---|

|

Department of Conservation |

Book Department of Conservation Asset |

51.9% |

30.4% |

58.5% |

|

NZ Customs Service |

SmartGate |

53.2% |

51.9% |

55.1% |

|

Ministry of Business, Innovation & Employment (Immigration NZ) |

Apply for Visa |

7.7% |

20.6% |

20.2% |

|

New Zealand Transport Agency |

Pay for Vehicle Licence |

27.2% |

32.9% |

32.8% |

|

New Zealand Police |

Pay for Fine |

52.1% |

56.4% |

58.1% |

|

Inland Revenue |

File an Individual Tax Return |

91.1% |

84.4% |

91.4% |

|

Pay Individual Tax |

87.9% |

86.0% |

90.9% |

|

|

Apply for an IRD Number |

0.0% |

20.9% |

21.5% |

|

|

Ministry of Social Development |

Apply for Financial Assistance (1) |

52.0% |

39.7% |

55.9% |

|

Department of Internal Affairs |

Renew Adult Passport (2) |

40.3% |

43.7% |

44.7% |

|

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

46.3% |

46.7% |

52.9% |

|

(1) A change in reporting methodology for the transaction Apply for Financial Assistance came into effect during October-December 2013. It resulted in a decrease in the digital uptake of this transaction across all periods.

(2) The figures shown for Renew Adult Passport are estimated.

Quarterly Measures - for July-September 2015

Agency |

Service |

July-

|

April-June 2015 |

July-

|

|---|---|---|---|---|

Department of Conservation |

Book Department of Conservation asset |

26.0% |

23.3% |

30.4% |

NZ Customs Service |

SmartGate departures and arrivals |

49.8% |

54.6% |

51.9% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

12.2% |

9.2% |

20.6% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

27.2% |

34.9% |

32.9% |

New Zealand Police |

Pay for fine on time |

49.1% |

54.9% |

56.4% |

Inland Revenue

|

File an Individual Tax Return |

80.5% |

91.3% |

84.4% |

Pay Individual Tax |

81.0% |

80.3% |

86.0% |

|

Apply for an IRD Number |

0.0% |

21.5% |

20.9% |

|

Ministry of Social Development |

Apply for Financial Assistance (1) |

37.4% |

37.8% |

39.7% |

Department of Internal Affairs |

Renew adult passport (2) |

40.6% |

45.0% |

43.7% |

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

40.4% |

45.3% |

46.7% |

|

(1) A change in reporting methodology for the transaction Apply for Financial Assistance came into effect during October-December 2013. It resulted in a decrease in the digital uptake of this transaction across all periods.

(2) The figures shown for Renew Adult Passport are estimated.

About these figures

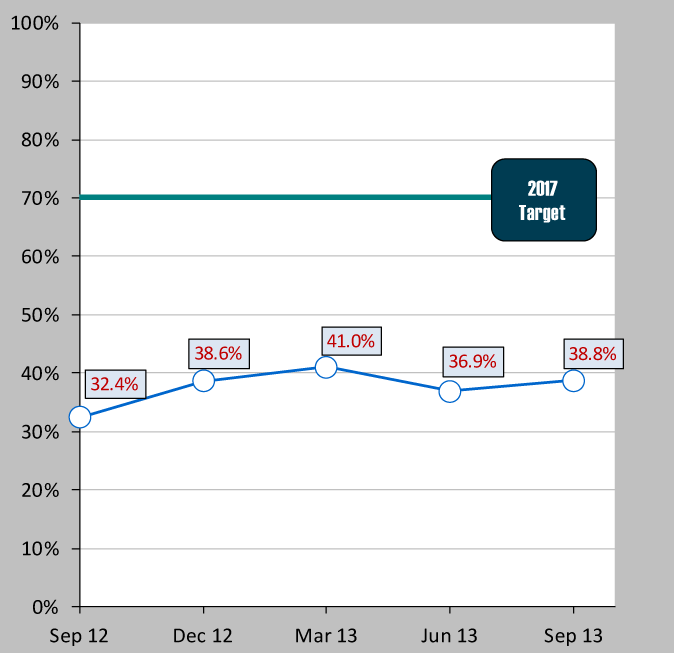

Progress towards the target has now been measured for thirteen quarters and started with a base figure of 29.9 per cent in June 2012.

The result for the July to September 2015 quarter shows that an average of 46.7 per cent of all transactions measured was completed digitally during the quarter. This is:

- 6.3 percentage points (or 15%) up on the comparable quarter of July to September 2014 (40.4% digital uptake). All ten of the indicator transactions showed increases on this comparable quarter .

- 1.4 percentage points up on the previous quarter (45.3% digital uptake in April to June 2015). Five transactions showed increases on that quarter, the biggest decrease for File an Individual Tax Return (IR) which is a seasonal influence.

Quarterly Measures - for April-June 2015

Agency |

Service |

Apr-Jun

|

Jan-Mar

|

Apr-Jun

|

|---|---|---|---|---|

Department of Conservation |

Book Department of Conservation asset |

23.5% |

39.6% |

23.3% |

NZ Customs Service |

SmartGate departures and arrivals |

52.4% |

52.8% |

54.6% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

8.8% |

7.1% |

9.2% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

26.2% |

29.8% |

29.8% |

New Zealand Police |

Pay for fine on time |

48.6% |

54.0% |

54.9% |

Inland Revenue

|

File an Individual Tax Return |

87.5% |

92.7% |

91.3% |

Pay Individual Tax |

69.5% |

79.1% |

80.3% |

|

Apply for an IRD Number |

0.0% |

1.2% |

21.5% |

|

Ministry of Social Development |

Apply for Financial Assistance (1) |

37.4% |

57.4% |

37.8% |

Department of Internal Affairs |

Renew adult passport (2) |

39.4% |

44.0% |

45.0% |

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

39.3% |

45.8% |

45.3% |

|

(1) A change in reporting methodology for the transaction Apply for Financial Assistance came into effect during October-December 2013. It resulted in a decrease in the digital uptake of this transaction across all periods.

(2) The figures shown for Renew Adult Passport are estimated.

About these figures

Progress towards the target has now been measured for twelve quarters and started with a base figure of 29.9 per cent in June 2012.

The result for the April to June 2015 quarter shows that an average of 45.3 per cent of all transactions measured was completed digitally during the quarter. This is:

- 6.0 percentage points up on the comparable quarter of April to June 2014 (39.3%). Nine transactions showed increases on that quarter, with one slightly decreasing.

- 0.5 percentage points down on the previous quarter (45.8 in Jan-Mar 2015). The two biggest decreases were for 'Booking a DOC Asset' (seasonal variation – bookings usually are made months ahead, ie entering Winter); and ‘Apply for Financial Assistance’ (a return to normal from the traditional March quarter spike of students applying for their allowance). Seven of the ten transactions showed an increase in digital uptake from the March 2015 quarter.

Quarterly Measures - for January-March 2015

Agency |

Service |

Jan-Mar

|

Oct-Dec 2014 |

Jan-Mar

|

|---|---|---|---|---|

NZ Customs Service |

SmartGate departures and arrivals |

48.0% |

53.2% |

52.8% |

Department of Internal Affairs |

Renew adult passport (1) |

38.1% |

40.3% |

44.0% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

10.3% |

7.7% |

7.1% |

Department of Conservation |

Book Department of Conservation asset |

30.7% |

51.9% |

39.6% |

New Zealand Police |

Pay for fine on time |

46.8% |

52.1% |

54.0% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

25.8% |

27.2% |

29.8% |

Inland Revenue

|

Apply for an IRD Number |

0.0% |

0.0 % |

1.2% |

File an Individual Tax Return |

91.7% |

91.1% |

92.7% |

|

Pay Individual Tax |

72.2% |

87.9% |

79.1% |

|

Ministry of Social Development |

Apply for Financial Assistance (2) |

56.2% |

52.0% |

57.4% |

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

42.0% |

46.3% |

45.8% |

|

(1) The figures shown for Renew Adult Passport are an estimate only.

(2) The indicator transaction Apply for Financial Assistance has had a change in reporting methodology which came into effect during the October-December 2013. The methodology change resulted in a decrease in the digital uptake of this transaction across all periods

Quarterly Measures - for October-December 2014

Agency |

Service |

Apr-Jun 2014 |

Jul-Sep 2014 |

Oct-Dec 2014 |

|---|---|---|---|---|

NZ Customs Service |

SmartGate departures and arrivals |

52.4% |

49.8% |

53.2% |

Department of Internal Affairs |

Renew adult passport (1) |

39.3% |

40.6% |

40.3% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

8.8% |

13.5% |

7.7% |

Department of Conservation |

Book Department of Conservation asset |

23.5% |

26.0% |

51.9% |

New Zealand Police |

Pay for fine on time |

48.6% |

49.1% |

52.1% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

26.2% |

27.2% |

27.2% |

Inland Revenue

|

Apply for an IRD Number |

0.0% |

0.0 % |

0.0% |

File an Individual Tax Return |

87.5% |

80.5% |

91.1% |

|

Pay Individual Tax |

69.5% |

81.0% |

87.9% |

|

Ministry of Social Development |

Apply for Financial Assistance |

37.4% |

37.4% |

52.0% |

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

39.3% |

40.5% |

46.3% |

|

(1) The figures shown for Renew Adult Passport are an estimate only.

The Result 10 measure gauges the overall transition of government transactions to the digital environment by measuring the progress of ten indicator transactions across eight agencies. These are regular, high-volume transactional services expected to have consistent levels of demand over the five year period. Information is collected quarterly from Department of Internal Affairs (DIA), New Zealand Police, New Zealand Customs Service, Inland Revenue (IR), Ministry of Social Development (MSD), Department of Conservation (DOC), Ministry of Business, Innovation and Employment (MBIE) (Immigration) and New Zealand Transport Agency (NZTA).

Note: ‘Apply for IRD Number’ currently shows zero percentage digital uptake. This service is not currently available online. Inland Revenue is working with other agencies on a secure combined approach to online authentication and verification issues (including the confidentiality of IRD numbers).

The October to December 2014 figures are the second quarter results in the third year of measuring progress towards Result 10 target measurement.

This quarter an average of 46.3% of New Zealanders chose to transact with government digitally. This is:

- 3.5 percentage points above the October-December 2013 quarter

- 5.8 percentage points above the July-September 2014 quarter

Some highlights from this quarter include:

- Book Department of Conservation asset: Overall visitors to the DOC website (link to www.doc.govt.nz) have continued to grow over the past year, increasing from 7.4 million in 2013 to 9.1 million in 2014 – an increase of 24%. This continues a trend of similar growth over the past few years. DOC is currently working on a refresh to further improve this site, which is due to launch in early 2015.

- Online Passport Renewal Service (Department of Internal Affairs): Online passport renewals continued to generate great feedback over the busy holiday period like:

“Hi just wanted to say that the service from the passport office had been fantastic. I was in a bit of a panic with some last minute business travel and an expired passport just before Christmas, but rang your helpdesk and was reassured that it would be done in time. I submitted the application online at 5 pm on 23 December, and my new passport was completed by 2pm on the 24th. Less than one working day! Thanks so much for the great service.” - Smartgate arrivals and depatures (New Zealand Customs Service): During this period SmartGate was also enabled for eligible Canadian passport holders. This change was formally announced by the Minister of Customs on 10 December.

Quarterly Measures - for July-September 2014

Agency |

Service |

Jan-Mar 2014 |

Apr-Jun 2014 |

Jul-Sep 2014 |

|---|---|---|---|---|

NZ Customs Service |

SmartGate departures and arrivals |

48.0% |

52.4% |

49.8% |

Department of Internal Affairs |

Renew adult passport (1) |

38.1% |

39.3% |

40.6% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

10.3% |

8.8% |

13.5% |

Department of Conservation |

Book Department of Conservation asset |

30.7% |

23.5% |

26.0% |

New Zealand Police |

Pay for fine on time |

46.8% |

48.6% |

49.1% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

25.8% |

26.2% |

27.2% |

Inland Revenue

|

Apply for an IRD Number |

0.0% |

0.0 % |

0.0% |

File an Individual Tax Return |

91.7% |

87.5% |

80.5% |

|

Pay Individual Tax |

72.2% |

69.5% |

81.0% |

|

Ministry of Social Development |

Apply for Financial Assistance |

56.2% |

37.4% |

37.4% |

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

42.0% |

39.3% |

40.5% |

|

(1) The figures shown for Renew Adult Passport are an estimate only.

The Result 10 measure gauges the overall transition of government transactions to the digital environment by measuring the progress of ten indicator transactions across eight agencies. These are regular, high-volume transactional services expected to have consistent levels of demand over the five year period. Information is collected quarterly from Department of Internal Affairs (DIA), New Zealand Police, New Zealand Customs Service, Inland Revenue (IR), Ministry of Social Development (MSD), Department of Conservation (DOC), Ministry of Business, Innovation and Employment (MBIE) (Immigration) and New Zealand Transport Agency (NZTA).

Note: ‘Apply for IRD Number’ currently shows zero percentage digital uptake. This service is not currently available online. Inland Revenue is working with other agencies on a secure combined approach to online authentication and verification issues (including the confidentiality of IRD numbers).

The July to September 2014 figures are the first quarter results in the third year of measuring progress towards Result 10 target measurement.

This quarter an average of 40.5% of New Zealanders chose to transact with government digitally. This is:

- 2.5 percentage points above the July-September 2013 quarter

- 1.2 percentage points above the April-June 2014 quarter

The July to September 2014 figures are for the first quarter of the third year of measuring progress towards Result 10 Target Measurement.

Some highlights from this quarter include:

- Smartgate arrivals and departures (New Zealand Customs Service): The annual international passenger survey run by Customs shows a statistically significant difference in satisfaction between SmartGate passengers and those who are processed manually: 92% overall satisfaction for the first group compared to 87% for the latter. Several people commented on how New Zealand’s immigration process is relatively smooth compared to other countries.

- Apply for financial assistance (MSD): In August a direct link to the Careers New Zealand CV Builder was added to the Self Service Kiosk homepage. This tool makes it easier for clients who don’t have personal access to the internet to:

- create and maintain a CV in a personal online account

- send their CV via a built-in email facility to apply for jobs

- meet their obligations to have an up-to-date CV.

Since adding the direct link to the CV Builder tool, traffic from the kiosks to the Careers NZ website has increased by over 50%.

Quarterly Measures - for April- June 2014

|

Agency |

Service |

Apr-Jun 2013 |

Jan-Mar 2014 |

Apr-Jun 2014 |

|---|---|---|---|---|

|

Department of Conservation |

Book Department of Conservation Asset |

20.9% |

30.7% |

23.5% |

|

NZ Customs Service |

SmartGate |

45.9% |

48.0% |

52.4% |

|

Ministry of Business, Innovation & Employment (Immigration NZ) |

Apply for Visa |

8.7% |

10.3% |

8.8% |

|

New Zealand Transport Agency |

Pay for Vehicle Licence |

24.2% |

25.8% |

26.2% |

|

New Zealand Police |

Pay for Fine |

42.0% |

46.8% |

48.6% |

|

Inland Revenue |

File an Individual Tax Return |

84.2% |

91.7% |

87.5% |

|

Pay Individual Tax |

64.3% |

72.2% |

69.5% |

|

|

Apply for an IRD Number |

0.0% |

0.0% |

0.0% |

|

|

Ministry of Social Development |

Apply for Financial Assistance (1) |

39.1% |

56.2% |

37.4% |

|

Department of Internal Affairs |

Renew Adult Passport (2) |

33.2% |

38.1% |

39.4% |

|

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

36.2% |

42.0% |

39.3% |

|

(1) A change in reporting methodology for the transaction Apply for Financial Assistance came into effect during October-December 2013. It resulted in a decrease in the digital uptake of this transaction across all periods.

(2) The figures shown for Renew Adult Passport are estimated.

Quarterly Measures - for January-March 2014

Latest results: July 2012 - March 2014 (last sevenquarters) .xlsx (17kb)**

**This file is in Microsoft Excel 2010 (.xlsx) format. If you do not have access to Excel 2010 you may use the Excel file viewer to view, print and export the contents of this file.

Agency |

Service |

Jan-Mar 2013 |

Oct-Dec 2013 |

Jan-Mar 2014 |

|---|---|---|---|---|

NZ Customs Service |

SmartGate departures and arrivals |

42.7% |

47.5% |

48.0% |

Department of Internal Affairs |

Renew adult passport (1) |

35.2% |

33.0% |

38.1% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

9.9% |

6.7% |

10.3% |

Department of Conservation |

Book Department of Conservation asset |

34.6% |

44.1% |

30.7% |

New Zealand Police |

Pay for fine on time |

39.6% |

44.6% |

46.8% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

20.1% |

24.1% |

25.8% |

Inland Revenue

|

Apply for an IRD Number |

0.0% |

0.0 % |

0.0% |

File an Individual Tax Return |

93.0% |

89.1% |

91.7% |

|

Pay Individual Tax |

67.3% |

84.1% |

72.2% |

|

Ministry of Social Development |

Apply for Financial Assistance |

67.7% |

61.1% |

56.2% |

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

41.0% |

43.4% |

42.0% |

|

(1) The figures shown for Renew Adult Passport are an estimate only.

The Result 10 measure gauges the overall transition of government transactions to the digital environment by measuring the progress of ten indicator transactions across eight agencies. These are regular, high-volume transactional services expected to have consistent levels of demand over the five year period. Information is collected quarterly from Department of Internal Affairs (DIA), New Zealand Police, New Zealand Customs Service, Inland Revenue (IR), Ministry of Social Development (MSD), Department of Conservation (DOC), Ministry of Business, Innovation and Employment (MBIE) (Immigration) and New Zealand Transport Agency (NZTA).

Note ‘Apply for IRD Number’ currently shows zero percentage digital uptake. This service is not currently available online. Inland Revenue is working with other agencies on a secure combined approach to online authentication and verification issues (including the confidentiality of IRD numbers).

For the January to March 2014 quarter, there is a 42.0% average digital uptake of the selected bundle of services. This is:

- 1.0% above the Jan-Mar 2013 Quarter.

- 1.4% below the Oct-Dec 2013 Quarter.

The January to March 2014 figures are for the third quarter of the second year of measuring progress towards Result 10 Target Measurement.

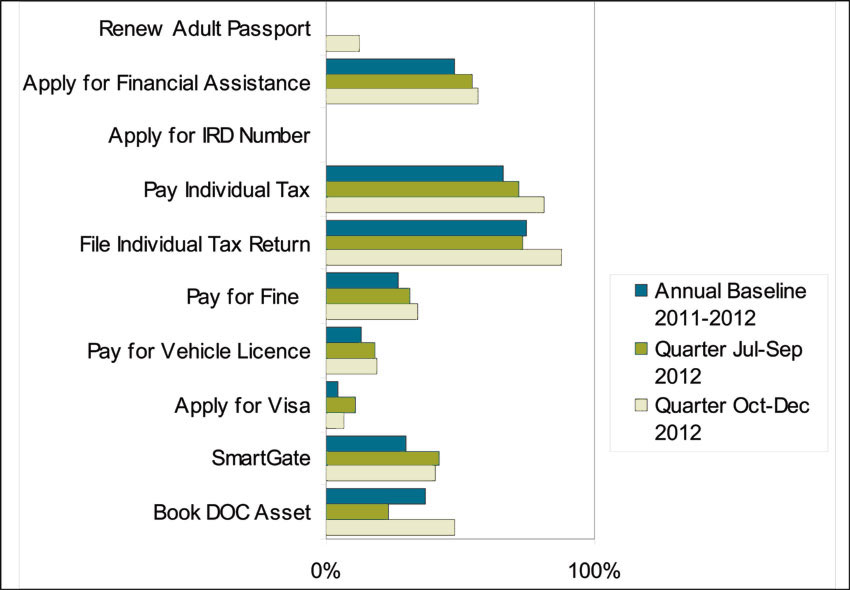

Quarterly Measures - for October-December 2013

Agency |

Service |

Uptake |

|---|---|---|

NZ Customs Service |

SmartGate departures and arrivals |

47.5% |

Department of Internal Affairs |

Renew adult passport |

33.0% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

6.7% |

Department of Conservation |

Book Department of Conservation asset |

44.1% |

New Zealand Police |

Pay for fine on time |

44.6% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

24.1% |

Inland Revenue

|

Apply for an IRD Number |

0.0 % |

File an Individual Tax Return |

89.1% |

|

Pay Individual Tax |

84.1% |

|

Ministry of Social Development |

Apply for Financial Assistance |

61.1% |

TOTAL AVERAGE PERCENTAGE FOR THE SECOND QUARTER |

43.4% |

|

The Result 10 measure gauges the overall transition of government transactions to the digital environment by measuring the progress of ten indicator transactions across eight agencies. These are regular, high-volume transactional services expected to have consistent levels of demand over the five year period. Information is collected quarterly from Department of Internal Affairs (DIA), New Zealand Police, New Zealand Customs Service, Inland Revenue, Ministry of Social Development (MSD), Department of Conservation (DOC), Ministry of Business, Innovation and Employment (MBIE) (Immigration) and New Zealand Transport Agency (NZTA).

Note ‘Apply for IRD Number’ currently shows zero percentage digital uptake. This service is not currently available online, pending resolving authentication and verification issues (including the confidentiality of IRD numbers). Inland Revenue is working with other agencies on a secure combined approach to online authentication.

What happened in the Second Quarter of FY13/14

For the December 2013 quarter, there is a 43.4% average digital uptake of the selected bundle of services. This is:

- 4.8% above the December 2012 Quarter.

- 4.6% above the September 2013 Quarter.

The October to December 2013 figures are for the second quarter of the second year of measuring progress towards Result 10 Target Measurement.

New Zealand Customs Service

Transaction: SmartGate – Arriving and Departing Passengers

Digital uptake of the service for period Oct-Dec 2013: 47.5%

Implementation

SmartGate is an automated passenger clearance system for New Zealand and Australian passport holders arriving at, and leaving, major international airports in New Zealand and arriving at Australia’s international airports. It delivers a smoother experience at the border for International travellers and efficiency gains for the Customs Service.

Recent Progress

In October, Customs reduced the minimum age for using SmartGate from 16 to 12. Since then, a weekly average of 670 eligible passengers in the new age group used SmartGate. Other initiatives driving uptake include improvements in biometric and gate performance and encouraging repeat use.

This has paid off, with 120,000 more travellers using SmartGate in the December 2013 quarter compared to the same period in 2012. On average, more than 60,000 people a week choose it. SmartGate was introduced in 2009 and since its roll out in Auckland, Wellington and Christchurch has been used by 7.5 million passenger movements.

A new, streamlined Departure Card is now in use at New Zealand’s international airports, thanks to collaboration by Statistics New Zealand, MBIE-Immigration and Customs. This is expected to improving the passenger experience and help SmartGate uptake.

Future improvements

Customs and Airport staff will encourage family groups to be processed through the SmartGate precinct in a trail at Auckland and Christchurch Airports. Eligible family members will use SmartGate, while non-eligible family members will be processed at the SmartGate referrals desk adjacent to the gate. Customs staff will monitor uptake.

Customs will focus on improving passenger experience and uptake and organisational efficiency.

- As the number of eligible electronic passports increases, the benefits of SmartGate, SmartGate Plus, and the Departure Information Project are also expected to increase.

- SmartGate arrivals could also be opened up to US and UK passport holders.

Link for further information

Department of Internal Affairs

Transaction: Renew Adult Passport

Digital uptake of the service for period Oct-Dec 2013: 33.4%

Implementation

The easiest way to renew a New Zealand passport is to do it online, from anywhere in the world. There is zero need to print forms, use snail mail or visit a Passport Office. New Zealand is the first and only country in the world to make this possible. DIA launched the service in November 2012.

Recent Progress

Having almost reached the first full-year target within 6 months, uptake plateaued somewhat. Focus has been on the last phase of Passport System Redevelopment Project in November 2013. The next enhancement to the online service – the photo checker tool – advanced well and was ready for deployment in January 2014.

Future improvements

The new photo checker tool enables customers and professional photographers to check whether their photo complies with the rules before they send their application. DIA made this enhancement available in January, and the success rate for successful first-time photo uploads has seen a significant improvement. Photo frustrations have been one of the most quoted reasons for difficulty of submission, so DIA anticipates uptake will start moving upward again.

Link for further information

http://www.passports.govt.nz/Adult-passport-renewal---form

Ministry of Business, Innovation and Employment – Immigration New Zealand

Transaction: Apply for visa

This includes all applicants for temporary entry class visas and residence visas but excludes those for refugee and protection category visas

Digital uptake of the service for period Oct-Dec 2013: 6.7%

Implementation

Note about seasonal shifts

- Quarterly peaks and troughs are more obvious with visa applications received electronically because we measure just a few visa types, a small percentage of the total number of applications. For example student visas – available electronically – produce peaks in applications linked to the start of school and university terms. Many Working Holiday Scheme visas are limited to a certain quota and reach that limit within a very short time (sometimes minutes).

- Usually we receive more applications – both paper and electronic – in the summer months, and less in the winter.

Progress in the last reporting period

- The new Student Visa online application project has completed development and testing is now under way. Deployment and business readiness planning has started.

- There was a decline in the number of digital visa applications in the December quarter, due to the cyclical nature of Student Visas.

Plans for the next reporting period

- Staff training for the new Student Visa forms will be underway.

- The Work visa and the Visitor visa digital applications are currently in design stage and due to enter development in March. Delivery of these digital visa applications is expected in November 2014.

Link for further information

http://www.immigration.govt.nz/

Department of Conservation

Transaction: Book Department of Conservation Asset

DOC offers online bookings for most of its recreation facilities – including Great Walks huts and campsites; many conservation campsites, backcountry huts, lodges, cabins and other accommodation; recreational hunting/fishing permits; and summer visitor programmes.

Digital uptake of the service for period Oct-Dec 2013: 44.1%

Implementation

Website visitors access the booking system from a prominent button on the homepage and from recreation pages throughout the DOC website.

Progress in the last reporting period

- DOC is upgrading its online asset booking system to deliver an easier and more efficient experience for customers.

- DOC staff began to use the new system, called i-Bex, to manage bookings for a range of DOC huts and campsites over the 2013/14 summer holiday season. The busy December booking period was used as a trial for the new tool. No significant issues were reported.

Plans for the next reporting periods

- The new system will go live for the public in the next quarter

- DOC will gradually add additional huts and campsites to the new booking system.

Link for further information

New Zealand Police

Transaction: Pay for Fine

This includes all infringements that are paid on time directly to the Police. This excludes all infringements that are forwarded to the Ministry of Justice for collection.

Digital uptake of the service for period Oct-Dec 2013: 44.6%

Implementation

New Zealand Police offers an online payment system for paying infringement fees. People can access this from a link at the top of the navigation panel on the main Police webpage (“Do it online now – Pay a ticket/infringement fee”). People can pay by Internet Banking or Credit Card. All infringement and subsequent reminder notices advise that the payments can be made electronically via the website.

Progress in the last reporting period

There was an increase in the number of people using the digital transaction. Non-digital payment channels (across a counter or by mail) continue to track downwards.

Link for further information

https://www.police.govt.nz/service/road/infringements.html

New Zealand Transport Agency

Transaction: Pay for Vehicle Licence

Digital uptake of the service for period Jul-Sept 2013: 24.8%

Implementation

The NZ Transport Agency makes it easy for customers to comply with regulations and do more transactions online. There is a clear ‘Relicence (rego) my vehicle’ button on the front page of the Transport Agency website.

Link for further information

Inland Revenue Department

Transaction: Pay individual tax

Digital uptake of the service for period Oct-Dec 2013: 84.1%

Implementation

Inland Revenue is improving ways for customers to pay individual tax electronically, and removing barriers to paying online. This includes:

- Giving customers options to pay via online banking and by debit and credit cards

- Providing clearer information and secure personal access through Inland Revenue’s website

- Promotion to customers of digital payments by Inland Revenue staff and agents.

Progress in the last reporting period

- Digital tax payments reached 84% this quarter, with over 19,000 more payments made digitally than in the same quarter last year.

- A new business-to-business digital channel created for tax return intermediaries is enabling them do more for their customers online, and helping their clients get tax refunds faster.

Plans for the next reporting period

- Further steps in the process to align timing for receipt of cheque and digital payments, to encourage more electronic tax payments by removing the current financial benefit some customers gain by paying by cheque.

- Continued promotion of improvements to Inland Revenue's digital services including myIR

Transaction: File individual tax return

Digital uptake of the service for period Oct-Dec 2013: 89.1%

Implementation

Inland Revenue uses a range of activities to promote online filing and help customers file tax returns electronically. These include:

- Making secure online services (MyIR) as easy as possible to use.

- Highlighting online services in Inland Revenue web and print publications, paid advertising and text messages.

- Community-based staff and partner organisations demonstrating online filing to customers and working with tax agents to encourage online filing of individual returns. One example of this is the New Zealand Government Office in Christchurch (YouTube).

- Contact centre staff advising callers about the benefits of online filing and how to do it.

Progress in the last reporting period

Nearly 90% of individual tax returns were filed digitally in this quarter. Improvements to myIR, Inland Revenue’s secure online service continued, making it faster and easier for customers to complete returns online without clicking between screens and sites. More than 1.7 million New Zealanders are now registered for myIR.

Plans for the next reporting period

Inland Revenue is looking at options for making myIR online registration faster and easier, by replacing a phone call needed to activate the account with a more accessible authentication process. Filing tax returns through mobile devices is also being explored.

Transaction: Apply for an IRD number

Digital uptake of the service for period Oct-Dec 2013: 0%

Currently individuals can't apply online for an IRD number (although companies can receive IRD numbers online via the Companies Office) so this is a significant stretch target.

Implementation

Inland Revenue is exploring options for applying for IRD numbers digitally. This is part of Inland Revenue’s overall transformation programme. Identity verification, security and confidentiality issues need to be resolved before a secure digital application process can be designed and implemented.

Progress in the last reporting period

Concepts for digital registration for new immigrants were tested in December with people holding work, student, permanent and working holiday visas. Customers found the digital service prototypes easy to use, and were positive about how integrating Immigration NZ and Inland Revenue services to provide IRD numbers at the border would minimise difficulties new arrivals face. The research also showed:

- If initial service is digital, customers expect subsequent services to be digital

- It’s important to provide only necessary information at each step - no more than the customer needs to understand their next action

- Government’s services are trusted by customers so government digital services are also trusted

- Digital services are more effective when tailored to the customer’s particular needs..

Plans for the next reporting period

Inland Revenue and Immigration New Zealand expect to complete the business case, with a preferred digital service option for IRD number applications alongside visa applications, by April 2014. Implementation is likely to be in early 2016.

Link for further information

Ministry of Social Development

Transaction: Apply for Financial Assistance (for example, benefits)

This includes applications for financial assistance through Work and Income, StudyLink and Senior Services.

Digital uptake of the service for period Oct-Dec 2013: 61.10%

NB: Welfare Reform changes came into effect on 15 July 2013. DIA has not yet assessed how this affects the Result 10 Target Measurement.

Progress in the last reporting period

In December, Work and Income launched the first phase of My Account enhancements, offering the RealMe service for clients to:

- change address and accommodation costs

- change bank account details

- declare income earned

- report job search

- stop receiving any Work and Income payments

- apply for financial assistance

- check eligibility with an online calculator.

Building on those improvements, work started on the second phase of My Account enhancements with RealMe services.

In November, StudyLink refreshed its website to make commonly used pages easier to find and to make it easier for students to successfully login. Also during this quarter, StudyLink approved a Business Case for design and development of a mobile view of ‘MyStudyLink’.

MSD also initiated planning for enhancements for the self-service kiosks.

Plans for the next reporting period

- MSD will work on enhancements to the self-service kiosks.

- StudyLink will deliver the mobile view of ‘MyStudyLink’.

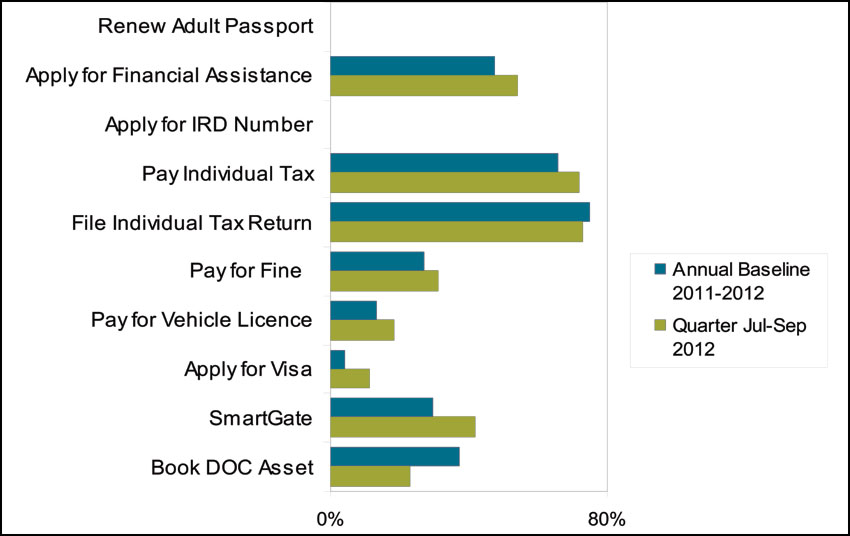

Quarterly Measures - for July-September 2013

(Quarter One - published December 2013)

Agency |

Service |

Uptake |

|---|---|---|

NZ Customs Service |

SmartGate departures and arrivals |

45.6% |

Department of Internal Affairs |

Renew adult passport |

31.4% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

11.5% |

Department of Conservation |

Book Department of Conservation asset |

27.9% |

New Zealand Police |

Pay for fine on time |

42.2% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

24.8% |

Inland Revenue

|

Apply for an IRD Number |

0.0 % |

File an Individual Tax Return |

77.9% |

|

Pay Individual Tax |

75.1% |

|

Ministry of Social Development |

Apply for Financial Assistance |

51.3% |

TOTAL AVERAGE PERCENTAGE FOR THE FIRST QUARTER |

38.8% |

|

The Result 10 measure gauges the overall transition of government transactions to the digital environment by measuring the progress of ten indicator transactions across eight agencies. These are regular, high-volume transactional services expected to have consistent levels of demand over the five year period. Information is collected quarterly from Department of Internal Affairs (DIA), New Zealand Police, New Zealand Customs Service, Inland Revenue, Ministry of Social Development (MSD), Department of Conservation (DOC), Ministry of Business, Innovation and Employment (MBIE) (Immigration) and New Zealand Transport Agency (NZTA).

Note ‘Apply for IRD Number’ currently shows zero percentage digital uptake. This service is not currently available online, pending resolving authentication and verification issues (including the confidentiality of IRD numbers). Inland Revenue is working with other agencies on a secure combined approach to online authentication.

What happened in the First Quarter

The July to September 2013 figures are for the first quarter of the second year of measuring progress towards Result 10 Target Measurement.

For this quarter, there is a 38.8% average digital uptake of the selected bundle of services. This is:

- 6.4% above the September 2012 Quarter.

- 1.9% above the June 2013 Quarter.

The increases reflect a combination of a real advance in digital uptake and the seasonal change anticipated for this time of year.

New Zealand Customs Service

Transaction: SmartGate – Arriving and Departing Passengers

Digital uptake of the service for period Jul-Sep 2013: 45.6%

Implementation

SmartGate is an automated passenger clearance system for New Zealand and Australian passport holders arriving at, and leaving, major international airports in New Zealand and arriving at Australia’s international airports. It delivers a smoother experience at the border for International travellers and efficiency gains for the Customs Service.

Recent Progress

On average more than 60,000 people a week choose the SmartGate automated passenger processing system. The September 2013 Quarter saw 100,000 more travellers using SmartGate compared to the same quarter in 2012. Customs expects to exceed the seven million passenger milestone before the end of 2013.

The number of arriving and departing passengers choosing to use SmartGate continued to grow. In the September 2013 Quarter:

- Arrivals: 419,413 passengers used SmartGate. This is 66.7% of all passengers eligible to use SmartGate and a slight decline of 0.2 percentage points over June 2013.

- Departures: 377,103 passengers used SmartGate. This is 59.7% of all passengers eligible to use SmartGate and a growth of 4.3 percentage points over June 2013.

Customs has extended SmartGate departures to ePassport holders from the United Kingdom and the United States.

Future improvements

- Customs is considering opening SmartGate to other nationalities and further reducing the age of eligibility.

- Customs trialled the next-generation SmartGate Plus prototype between June and October in Air New Zealand’s premier departure area at Auckland International Airport. SmartGate Plus used face-on-the-fly technology to photograph the passenger as they approach the scanner and matches it to the photo in their passport, eliminating the kiosk and ticket part of the current process. The entire one-step process takes around nine seconds. Customs is developing a business case to implement the pilot, however no timeframe has been set.

Link for further information

Department of Internal Affairs

Transaction: Renew Adult Passport

Digital uptake of the service for period Jul-Sept 2013: 31.4%

Implementation

The easiest way to renew a New Zealand passport is to do it online, from anywhere in the world. There is zero need to print forms, use snail mail or visit a Passport Office. New Zealand is the first and only country in the world to make this possible. DIA launched the service in November 2012.

Recent Progress

The online service continues to be positively received:

- The September 2013 Quarter saw nearly 34,000 adults renew their passport online.

- In the eleven months since the service was launched, almost 112,000 New Zealand adults across the globe have been issued a passport after using the online renewal service.

Future improvements

- From February 2014, there will be a new tool that delivers instant feedback on the suitability of digital photos of applicants.

- To help New Zealanders save time and money, DIA plans to enable online passport renewal applicants to establish a verified RealMe account during their passport application process.

Link for further information

http://www.passports.govt.nz/Adult-passport-renewal---form

Ministry of Business, Innovation and Employment – Immigration New Zealand

Transaction: Apply for visa

This includes all applicants for temporary entry class visas and residence visas but excludes those for refugee and protection category visas

Digital uptake of the service for period Jul-Sept 2013: 11.5%

Implementation

The percentage digital has increased from 8.73% in the June 2013 Quarter to 11.49% for the September Quarter. This represents the seasonal nature of online visa applications.

Note about seasonal shifts

- Quarterly peaks and troughs are more obvious with visa applications received electronically because we are measuring just a few visa types, only a small percentage of the total number of applications. For example student visas – available electronically – produce peaks in applications linked to the start of school and university terms. Many Working Holiday Scheme visas are limited to a certain quota and reach that limit within a very short time (sometimes minutes).

- Usually we receive more applications – both paper and electronic – in the summer months, and less in the winter.

Recent progress

Immigration New Zealand has built the first Student Online form and is now working on temporary work forms. Student Online offers a number of benefits to both education providers and students; for example, students can have their applications processed within 48 hours, and education providers gain greater control over applications and are better able to meet pastoral care requirements.

Future improvements

Research into usability of the Student Online application is scheduled for early 2014. Immigration is also testing related business processes including identity and biometric requirements, and migrating around 45 million identities into the Immigration Global Management System.

MBIE expects overall digital uptake to increase progressively from the middle of 2014. This is slightly later than originally expected because (as previously reported), deployment of MBIE’s new IT infrastructure meant a timing shift for ‘go live’ with online products from late 2013 into 2014.

Link for further information

http://www.immigration.govt.nz/

Department of Conservation

Transaction: Book Department of Conservation Asset

This includes all individual bookings for Department of Conservation recreational assets, such as huts, Great Walks, campsites and permits.

Digital uptake of the service for period Jul-Sept 2013: 27.9%

Over the July to September quarter the following project milestones have been achieved:

Implementation

- DOC offers online bookings for most of its recreation facilities – including Great Walks huts and campsites; many conservation campsites, backcountry huts, lodges, cabins and other accommodation; recreational hunting/fishing permits; and summer visitor programmes.

- Website visitors access the booking system from a prominent button on the homepage and from recreation pages throughout the DOC website. DOC has a work programme in place to make it easier for people to do business with DOC online.

Recent Progress

- DOC is upgrading its online booking system to deliver an easier and more efficient experience for customers booking DOC recreation online.

- The new system now offers online bookings for nine campgrounds not previously bookable online.

- The upgrade will also improve back-end management of bookings.

Future improvements

- The new booking system will make it easier for other parties – including travel agents and travel booking websites – to sell DOC recreation experiences in the future.This means customers will be able to make bookings in the way that best suits them; whether that’s through selected online booking sites, travel agents, tourism operators, DOC visitor centres, or independently on the DOC website.

- In coming months DOC plans to add further assets (eg, campsites, huts etc) to the new booking system.

Link for further information

New Zealand Police

Transaction: Pay for Fine

This includes all infringements that are paid on time directly to the Police. This excludes all infringements that are forwarded to the Ministry of Justice for collection.

Digital uptake of the service for period Jul-Sept 2013: 42.2%

Increase in digital uptake from last quarter: 0.2%.

Implementation

New Zealand Police offers an online payment system for paying infringement fees. People can access this from a link at the top of the navigation panel on the main Police webpage (“Do it online now – Pay a ticket/infringement fee”). People can pay by Internet Banking or Credit Card. All infringement and subsequent reminder notices advise that the payments can be made electronically via the website.

Link for further information

https://www.police.govt.nz/service/road/infringements.html

New Zealand Transport Agency

Transaction: Pay for Vehicle Licence

Digital uptake of the service for period Jul-Sept 2013: 24.8%

The percentage of people paying for their vehicle licence online shows only a marginal (0.6%) quarterly increase, the actual number of payments for vehicle licences increased by 21,000. Also, the percentage of digital transactions has almost doubled from the June 2012 baseline of 13.1%.

Implementation

The NZ Transport Agency makes it easy for customers to comply with regulations and do more transactions online. There is a clear ‘Relicence (rego) my vehicle’ button on the front page of the Transport Agency website.

Recent progress

The NZ Transport Agency website has a new home page with increased visibility of the pay vehicle licence transaction. The Transport Agency’s refocus on the needs of customers has driven development of a new ‘plug and play’ core payment service to manage online transactions. What this means:

- Old way: a customer wanting to pay online (for example) for rego renewal, road user charges, and toll charges had to make three individual transactions, requiring filling in the online form three times, making three payments, and getting frustrated. The regulations compelled the Transport Agency to do it this way

- New way: (assuming recommendations are accepted by Cabinet) a customer wanting to pay online for multiple products can pull them all together into a single payment experience – similar to what might happen with a retail website where the customer adds multiple products to an online shopping cart and pays once.

Future improvements

The Transport Agency is working on new ways to ensure people make payments on time and encourage uptake of digital self service through better customer experience. These include new smarter portals, and more digital channel choice via smartphones and other mobile devices.

Link for further information

Inland Revenue Department

Transaction: Pay individual tax

Digital uptake of the service for period Jul-Sept 2013: 75.1%

This represents a rise of almost ten percentage points from the June Quarter percentage of 64.3%, and is 3.3 percentage points above the same quarter last year.

Implementation

Inland Revenue is improving ways for customers to pay individual tax electronically, and removing barriers to paying online. This includes:

- Giving customers options to pay via online banking and by debit and credit cards

- Providing clearer information and secure personal access through Inland Revenue’s website

- Promotion to customers of digital payments by Inland Revenue staff and agents.

Future improvements

- Timing for receipt of cheque and digital payments will be aligned, to remove a "3 days grace" benefit customers gained by paying by cheque, and encourage further electronic payments.

- Further activities within the integrated payment plan to increase electronic uptake, and continued promotion of Inland Revenue's digital services.

Transaction: File individual tax return

Digital uptake of the service for period Jul-Sept 2013: 77.9%

The seasonal variation of income tax returns, produced a slightly reduced percentage for digital filing in the September Quarter compared to the June Quarter. However:

- Digital filing increased almost five percentage points compared to the September 2012 Quarter.

Implementation

Inland Revenue uses a range of activities to promote online filing and help customers file tax returns electronically. These include:

- Making secure online services (MyIR) as easy as possible to use.

- Highlighting online services in Inland Revenue web and print publications, paid advertising and text messages.

- Community-based staff and partner organisations demonstrating online filing to customers and working with tax agents to encourage online filing of individual returns.

- Contact centre staff advising callers about the benefits of online filing and how to do it.

Recent Progress

Inland Revenue staff continued to promote digital services to customers through a range of channels, including via the New Zealand Government office in Christchurch. 1.6 million New Zealanders are now registered to use myIR secure online services and tools.

Future improvements

A planned redesign of the Inland Revenue website in 2014 will improve the user-friendliness and make it easier for customers to find relevant information and digital tools.

Transaction: Apply for an IRD number

Digital uptake of the service for period Jul-Sept 2013: 0%

Currently individuals can't apply online for an IRD number (although companies can receive IRD numbers online via the Companies Office) so this is a significant stretch target.

Implementation

Inland Revenue is exploring options for applying for IRD numbers digitally. This is part of Inland Revenue’s overall transformation programme. Identity verification, security and confidentiality issues need to be resolved before a secure digital application process can be designed and implemented.

Recent progress

Since July 2013, 93% of parents registering the birth of their child have opted to apply for an IRD number for the child at the same time, saving new parents hours of time and effort. An IRD number is needed to apply for Working for Families, open a KiwiSaver or bank account for the baby, or manage child support arrangements. While applications are currently paper-based they pave the way for a future digital service.

Future improvements

Inland Revenue and Immigration New Zealand are exploring design options for issuing IRD numbers digitally as part of the process when people enter the country, re-using verified identity information from MBIE’s new Immigration Global Management System. The two agencies expect to complete a business case with a preferred option by April 2014, and a digital solution for applying for IRD numbers may be available by early 2016.

Link for further information

Ministry of Social Development

Transaction: Apply for Financial Assistance (for example, benefits)

This includes applications for financial assistance through Work and Income, StudyLink and Senior Services.

Digital uptake of the service for period Apr-Jun 2013: 51.3%

NB: Welfare Reform changes came into effect on 15 July 2013. DIA has not yet assessed how this affects the Result 10 Target Measurement.

Recent progress

- Across the Ministry, investment continued to improve online information security, and self-service kiosks were rolled out to all sites.

- StudyLink began website enhancements that include an interactive online account and a tool for applying online.

Future improvements

- Work and Income will continue work to add new services to My Account

- StudyLink plans to make more online services available via mobile devices.

Links for further information

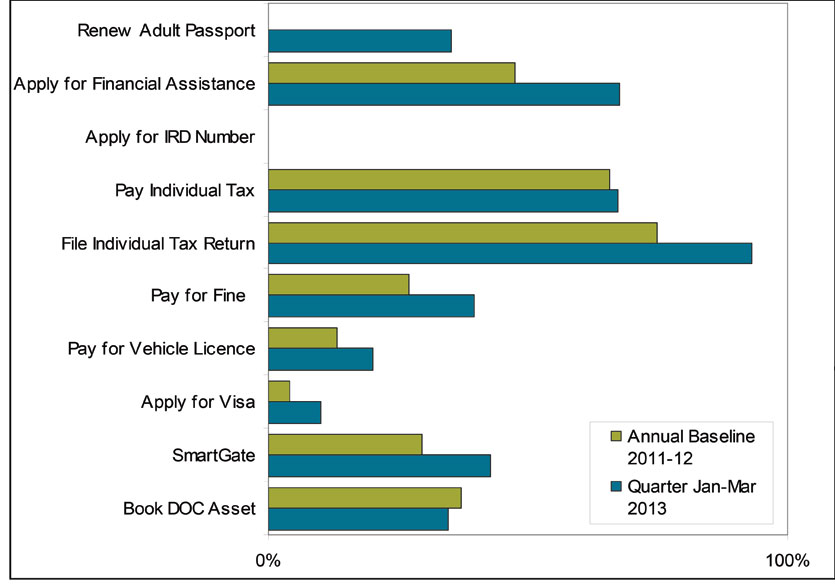

|

Agency |

Service |

Apr-Jun 2012 |

Jan-Mar 2013 |

Apr-Jun 2013 |

|---|---|---|---|---|

|

Department of Conservation |

Book Department of Conservation Asset |

n/a |

34.6% |

20.9% |

|

NZ Customs Service |

SmartGate |

n/a |

42.7% |

45.9% |

|

Ministry of Business, Innovation & Employment (Immigration NZ) |

Apply for Visa |

n/a |

9.9% |

8.7% |

|

New Zealand Transport Agency |

Pay for Vehicle Licence |

n/a |

20.1% |

24.2% |

|

New Zealand Police |

Pay for Fine |

n/a |

39.6% |

42.0% |

|

Inland Revenue |

File an Individual Tax Return |

n/a |

93.0% |

84.2% |

|

Pay Individual Tax |

n/a |

67.3% |

64.3% |

|

|

Apply for an IRD Number |

n/a |

0.0% |

0.0% |

|

|

Ministry of Social Development |

Apply for Financial Assistance |

n/a |

62.0% |

39.1% |

|

Department of Internal Affairs |

Renew Adult Passport (1) |

n/a |

35.2% |

33.2% |

|

TOTAL AVERAGE PERCENTAGE FOR THE QUARTER |

n/a |

40.4% |

36.2% |

|

(1) The figures shown for Renew Adult Passport are estimated.

Quarterly Measures - for January-March 2013

(Quarter Three - published July 2013)

Agency |

Service |

Uptake |

|---|---|---|

NZ Customs Service |

SmartGate departures and arrivals |

42.7% |

Department of Internal Affairs |

Renew adult passport |

35.2% |

Ministry of Business Innovation & Employment(Immigration New Zealand) |

Apply for visa |

9.9% |

Department of Conservation |

Book Department of Conservation asset |

34.6% |

New Zealand Police |

Pay for fine on time |

39.6% |

New Zealand Transport Agency |

Pay for Vehicle Licence |

20.1% |

Inland Revenue

|

Apply for an IRD Number |

0.0 % |

File an Individual Tax Return |

93.0% |

|

Pay Individual Tax |

67.3% |

|

Ministry of Social Development |

Apply for Financial Assistance |

67.7% |

TOTAL AVERAGE PERCENTAGE FOR QUARTER THREE |

41.0% |

|

The Result 10 measure gauges the overall transition of government transactions to the digital environment by measuring the progress of 10 ‘indicator’ transactions across eight agencies. These are regular, high-volume transactional services expected to have consistent levels of demand over the five year period. Information is collected quarterly from Department of Internal Affairs (DIA), New Zealand Police, New Zealand Customs Service, Inland Revenue (IR), Ministry of Social Development (MSD), Department of Conservation (DOC), Ministry of Business, Innovation and Employment (MBIE) (Immigration) and New Zealand Transport Agency (NZTA).

What happened in the Third Quarter

Digital uptake of the selected bundle of services rose from an average of 38.6% in the December quarter to an average of 41% in the March quarter. This continues an upward trend from the baseline average (established in June 2012) of 29.9%.

All agencies have made progress since the baseline measure, with most of the transactions trending upwards in this quarter. Worth mentioning are:

- Helping customers help themselves: The New Zealand Government Office opened in Christchurch in February. This cross-agency office in Sydenham gives access to a range of direct and online services from MSD and IR. Self-service work stations[1] are now up and running – customers can look up information and complete simple online transactions themselves. Office staff support customers, especially people unused to technology, to navigate systems and gain confidence in using online government services. From day one customers began registering for MyIR online services and/or making applications to MSD.

- Identity verification: MSD began work to encourage use of the Department’s igovt Identity Verification Service to positively authenticate customers' identities online. This project will gain leverage from the igovt Logon Service. As at 31 March, more than 206,000 igovt logins were linked to StudyLink’s Student Allowance and Loan system.

- Website improvements: A number of agencies have reported on website upgrades during the quarter, improving usability, and increasing the capability of agencies to deliver better service (eg, web analytics to understand customer behaviour). Agencies are planning further website and mobile technology upgrades to encourage online transactions and remove administrative barriers that prevent or slow online payment uptake.

Other recent progress sets the scene for Result 10 dividends in the future. For example, from July this year, IR and the DIA will enable parents to apply for an IRD number for their child and register the birth at the same time in the same process. While paper-based initially, it's a foundation for future digital service, with IR and MBIE considering whether IRD numbers could be issued digitally as part of immigration management when people enter the country.

Of course, seasonal fluctuations in customer behaviour should be expected, and this is evident in the quarterly figures from IR and DOC. There was the usual seasonal drop in online payments of individual tax, with digital payments down from 81.2% in the December quarter to 67.3% in this quarter. Still, this March quarter figure is 4.6% higher than the same quarter last year. There was also a dip in bookings for DOC recreational assets such as huts, Great Walks, campsites and permits. Some DOC assets are only bookable online and more people use them in summer, so after the usual Spring spike (from 22.8% to 42.1%), bookings have settled back down to 34.6% in the March quarter.

Note that ‘Apply for IRD Number’ shows a 0% digital uptake as this service is not currently available online, pending resolving authentication and verification issues (including the confidentiality of IRD numbers). Inland Revenue is working with other agencies on a secure combined approach to online authentication.

New Zealand Customs Service

Transaction: SmartGate – Arriving and Departing Passengers

Digital uptake of the service: 42.7%

How is it being implemented?

SmartGate is an automated passenger clearance system for New Zealand and Australian passport holders arriving at, and leaving, major international airports in New Zealand and arriving at Australia’s international airports. SmartGate responds to the Government’s wish to provide a better, smoother experience for travellers and helps make processing international travellers at the border more effective and efficient.

Recent Progress

SmartGate is now well established, with continuing growth in the number of arriving and departing passengers using SmartGate at New Zealand’s three main airports. In March 2013:

- Arrivals: 118,431 passengers used SmartGate, representing growth of 22.8% over the March 2012.

- Departures: 105,967 passengers used SmartGate; this represented a growth of 18.5% over March 2012.

Future Plans

New Zealand Customs Service is developing innovations including pilot testing a SmartGate process that does not require a kiosk transaction. The agency is working with Statistics New Zealand and Immigration to streamline paper-based requirements ahead of plans to fully automate the departure information collection process. An enhanced Departure Card is on schedule for release in the middle of 2013.

Promotion of SmartGate will be maintained as the number of passengers with an electronic passport increases. New Zealand Customs Service will focus on continuous improvement in passenger experience and uptake, organisational efficiency and risk management.

Link for further information

Department of Internal Affairs

Transaction: Renew Adult Passport

Digital uptake of the service: 35.2%

How is it being implemented?

The Department of Internal Affairs is developing new systems and processes to issue passports as part of its Passport Redevelopment Programme, which aims to improve passport security and service to the public in a more cost effective manner.

Recent Progress

In November 2012, the Department launched the new online passport renewal service which enables the majority of adult New Zealanders who have previously been issued with a passport to apply for their new passport online. The fee for the new service is lower than that for paper-based applications.

The reporting period – to the end of March 2013 – captures three full months of the new online service. Over this period approximately 35% of adults receiving a renewed passport had applied using the online service. This equates to over 31,000 individual passports.

Future plans

The Department will continue to fine tune the operation of the new online service, and to promote its use.

Link for further information

http://www.passports.govt.nz/Adult-passport-renewal---form

Ministry of Business, Innovation and Employment – Immigration New Zealand

Transaction: Apply for visa

This includes all applications for temporary entry class visas and residence visas but excludes refugee and protection category visas

Digital uptake of the service: 9.9%

How is it being implemented?

Visa applications received electronically are limited to just a few types, and consequently represent only a small percentage of the total number of applications received. Quarterly fluctuations (eg student visas peak before university or school terms) can therefore appear greater.

Recent progress

The 'percentage digital' has increased from 6.9% in the previous quarter to 9.9% this quarter. This was to be expected due mainly to the seasonal nature of online visa applications.

Immigration New Zealand (INZ) is implementing the Immigration Global Management System Project for a modern, fit-for-purpose immigration system that utilises online technology to its fullest. The new system will roll out progressively from 2013, and 70 per cent of visa applications will be done online by 2017.

- Customers will be able to apply online, upload documents, communicate with INZ and get one-stop-shop access to immigration services.

- For employers, education providers and other immigration partners, it means faster and cost-effective processing.

- INZ will have a better way of working that is streamlined, efficient and responsive to customers’ needs and government priorities.

Future plans

The Ministry's range of online products will increase during the last quarter of 2013, to include visa applications for Student and Temporary Work. This development is expected to increase the overall digital uptake progressively from the first quarter of 2014.

Link for further information

http://www.immigration.govt.nz/

Department of Conservation

Transaction: Book Department of Conservation Asset

This includes all individual bookings for Department of Conservation recreational assets, such as huts, Great Walks, campsites and permits.

Digital uptake of the service: 34.6%

How is it being implemented?

DOC is implementing several projects to improve its online service offering. The key project relating to bookable assets is ‘Book and pay for facilities and experiences online’. A number of DOC assets are already bookable online, including some huts and campsites.

Recent Progress

A proposed new booking system is expected to increase the number of bookable assets; add to the online locations where the bookings can occur; and improve the user experience. A vendor has been selected for the system and a business case for implementation is being made. A decision on proceeding with this project is expected before the end of July.

Future Plans

DOC will continue with its marketing activities to promote online bookings of DOC assets. This will include promotion of Great Walks through a campaign in partnership with Air New Zealand, and of DOC huts through a recently announced partnership with Dulux.

Link for further information

http://www.doc.govt.nz/parks-and-recreation/places-to-stay/backcountry-huts-by-region/

New Zealand Police

Transaction: Pay for Fine

This includes all infringements that are paid on time directly to the Police. This excludes all infringements that are forwarded to the Ministry of Justice for collection.

Digital uptake of the service: 39.6%

How is it being implemented?

Credit Card Payments can be made directly through the Police web site [embedded URL: https://www.paymentsonline.co.nz/OnlinePaymentServlet?cd_community=NZPolice&cd_currency=NZD&cd_supplier_business=NZPolice ]. The site provides details of how to pay via internet banking services on the Infringements web page. All infringement and subsequent reminder notices advise that the payments can be made electronically via the website.

Recent Progress

The uptake in use of the digital channel saw a quarterly increase from 33.9% to 39.6%.

Future plans

Electronically delivered infringement notices are being upgraded to specify that the fine can be paid through Internet Banking.

Link for further information

https://www.police.govt.nz/service/road/infringements.html

New Zealand Transport Agency

Transaction: Pay for Vehicle Licence

Digital uptake of the service: 20.1%

How is it being implemented?

The NZ Transport Agency (NZTA) is committed to making it easy for customers to comply with regulations and is encouraging them to do more transactions online. The agency recently surveyed customers to establish the issues in online transactions and what could be done to improve its service.

Recent progress

There was a small upward nudge in this quarter of 1.4 percentage points, but NZTA fully expects the proportion of people paying for a Vehicle Licence online to move beyond that as a result of campaigning to promote the online payment option, including via the 90,000 vehicle licensing reminders posted to customers each week and advertising on the government website (http://newzealand.govt.nz/). Web analytics have enabled NZTA to analyse how customers use the website and where they drop out. This is especially important if they drop out before completing a transaction.

Future plans

There will no longer be a maximum purchase limit of $1000 for Road User Charges. NZTA customers said in an online survey and in face-to-face meetings that the limit of $1000 was inconvenient and sometimes required multiple transactions to purchase the amount they wanted.

Other NZTA initiatives to lift online uptake include future participation in the NZ Post YouPost pilot, advertising content on http://newzealand.govt.nz and addressing online usability for customers.

Link for further information

https://transact.nzta.govt.nz/transactions/RenewVehicleLicence/entry.aspx

Inland Revenue Department

Transaction: Pay individual tax

Digital uptake of the service: 67.3%

How is it being implemented?

Inland Revenue is continuing to improve ways for customers to pay individual tax electronically, and to remove any barriers to paying online. This includes:

- giving customers options to pay via online banking and by debit and credit cards

- providing clearer information and secure personal access through IR’s website.

Recent Progress

- While there was an expected seasonal drop in online payments of individual tax this quarter (down from 81.2% in the December quarter to 67.3% in this period), digital payments overall continued to grow, with an increase of 4.6 percentage points on January-March 2012. Year-to-date, online payments are 72.3% of all individual tax payments

- Work started on aligning cheque and electronic payment processes to eliminate a current benefit for customers using cheques and encourage further digital payment

- Online, direct mail and targeted text message campaigns continued to encourage customers to use online payment channels.

Future plans

- A new eAlerts service, which contacts customers electronically with reminders about tax payments and confirms online transactions, is scheduled to go live. While eAlerts are currently for business customers filing GST through myIR secure online services (and therefore not captured in this measure), they may extend to individual customers in future, providing certainty that will encourage more online payments.

- Continued promotion of the mobile web application, Voice ID and secure online services.

Transaction: File individual tax return

Digital uptake of the service: 93.0%

How is it being implemented?

Inland Revenue uses a range of activities to promote online filing and help customers file tax returns electronically. These include:

- Making secure online services as easy as possible to use.

- Highlighting online services in IR's web and print publications, paid advertising and text messages.

- Community-based staff and partner organisations demonstrating online filing to customers and working with tax agents to encourage online filing of individual returns.

- Contact centre staff advising callers about the benefits of online filing and how to do it.

Recent Progress