- Charities Amendment Bill

- Policy decisions to modernise the Charities Act 2005

- Targeted engagement (2021) and stakeholder feedback

- Public consultation and submissions (2019)

- Charities appeals regulations

- Background to the work to modernise the Charities Act

- Overview of the charitable sector and the Charities Act

- Frequently Asked Questions

Policy decisions to modernise the Charities Act 2005

Updated 1 November 2022

- Policy decisions to modernise the Charities Act 2005 (June 2022)

- Frequently asked questions (updated 23 September 2022)

- Cabinet material approving the introduction of the Charities Amendment Bill (31 October 2022)

- Release of briefing papers leading to policy decisions (July 2022)

- Policy documents 2018-2019

- Contact the team

The Minister for the Community and Voluntary Sector, Hon Priyanca Radhakrishnan has announced a suite of changes to improve the operation of the Charities Act. The policy decisions are set out below.

Read the Minister’s announcement here: Charities Act changes to benefit NZ Communities (2 June 2022)

Regulatory decision-making

Changes will be made to the regulator’s decision-making processes:

- Te Rātā Atawhai, the Charities Registration Board (the Board) will be required to publish all decline and deregistration decisions and provide a clear process for charities to object to significant decisions.

- The timeframe for submitting information to Charities Services on administrative matters (such as providing more information on an application) will be extended from 20 working days to two months.

- Charities Services will be required to consult with the sector when developing significant guidance material.

These changes acknowledge that many charities are run by volunteers and need more time to engage with the decision-making process. The changes support charity participation in the regulatory system, provide greater clarity on regulatory decision-making, and allow charities to focus on their important mahi.

The number of members of the Board will also be increased from three to five. This will improve the Board’s diversity of backgrounds and experience and address potential quorum and conflict of interest issues.

Appeals framework

The Taxation Review Authority will be used to hear first appeals under the Charities Act instead of the High Court. Stakeholders noted during consultation that the High Court was often inaccessible because it was legally complex, costly, and time consuming. The High Court will still function as an appeal court for decisions by the Taxation Review Authority.

The Taxation Review Authority will provide greater accessibility than the High Court in the appeals process by allowing charities to self-represent. This will reduce charities’ costs and make the process less formal.

The range of decisions that can be appealed will include significant decisions made by Charities Services (as well as the existing decisions made by the Board). The timeframe for lodging an appeal will be extended from 20 working days to two months.

Compliance and enforcement powers

It is important to have the appropriate compliance and enforcement functions in a regulatory system to ensure the effective functioning of the system and make it clear for participants in the system to understand their obligations.

Three changes will be made to improve the compliance and enforcement functions for charities. These changes will:

- make explicit the currently implicit obligations for charities to remain qualified for registration. These obligations are maintaining charitable purpose, having a rules document, and having qualified officers;

- clarify what is meant by serious wrongdoing, defined as an offence punishable by two or more years of imprisonment; and

- allow the Board to disqualify an officer for serious wrongdoing or a significant or persistent breach of obligations, without deregistering the charity.

Charities accumulating funds

Larger charities in tiers 1 to 3 will be required to report the reasons for their accumulated funds (including cash, assets or other resources). The reporting is intended to provide greater clarity on why funds are held and improve public trust and confidence in the charitable sector.

This is not a legislative change and will be implemented through a change to the annual return form. Charities Services will work with iwi to design changes to the annual return form to reflect te ao Māori views of accumulation.

Reporting requirements for very small charities

The Department’s Chief Executive will have the power to exempt very small charities from the financial reporting standards set by the External Reporting Board to reduce the compliance burden while balancing the needs of transparent reporting. The threshold will be developed in regulations (in consultation with the sector). The Department’s analysis suggested a threshold of annual payments under $10,000 and total assets under $30,000 that would benefit 12 percent of all registered charities.

Charities that are exempt from the reporting standard will still be required to file an annual return with basic financial information.

Officers of charities and governance improvements

The definition of officer will be amended to capture all persons with significant influence over the management or administration of the entity, regardless of the type of entity. The definition in the Charities Amendment Bill will align with the definition of an officer in the Incorporated Societies Act 2022.

The disqualifying factors to becoming an officer will be updated. Persons who have been convicted of an offence relating to the financing of terrorism will be prevented from holding an officer role in a charity.

The minimum age requirements to be an officer will be changed. At least one officer of the charity will need to be 18 years old or over (while the remaining officers can be 16 years old or over).

Officers are collectively responsible for the governance of the charity. The Charities Amendment Bill will specify that the role of an officer is to support the charity to meet its obligations for greater clarity.

Charities will also be required to review their rules document every year to ensure its governance arrangements are up to date and appropriate.

These changes are intended to improve the accountability and governance of charities, as well as creating greater alignment with other legislation that charities might be governed by such as the Companies Act 1993, Trusts Act 2019, Incorporated Societies Act 2022, and the Charitable Trusts Act 1957.

Cabinet paper and Regulatory Impact Statement

For more detail on the policy decisions, please refer to the Cabinet paper and the Regulatory Impact Statement here:

- Minute and Cabinet paper - Modernising the Charities Act (PDF, 1.3MB)

- Minute of Decision: Modernising the Charities Act 2005

- Cabinet paper: Modernising the Charities Act 2005: policy proposals

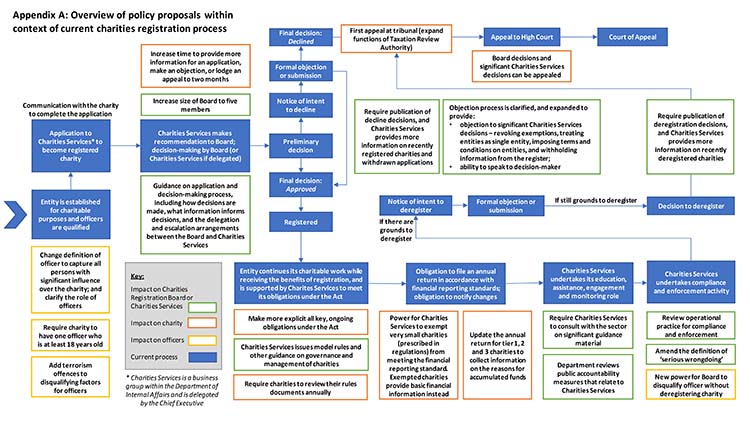

(To view diagram below, click on image for PDF version - 1MB)

Cabinet material approving the introduction of the Charities Amendment Bill

Release of briefing papers leading to policy decisions (published July 2022)

The Department has proactively released briefing papers relating to the policy work to modernise the Charities Act:

Cover sheet: Briefing papers relating to the policy work to modernise the Charities Act [PDF, 129KB]

1. Policy briefing - options for progressing work on the Charities Act [PDF, 1.7MB]

2. Policy briefing - scope of work to progress modernising the Charities Act [PDF, 1.8MB]

3. Objectives for modernising the Charities Act, and early analysis of reporting requirements for small charities [PDF, 1.2MB]

4. Information briefing - accumulation of funds by large charities [PDF, 2.4MB]

5. Information briefing - charities with business activities [PDF, 1.5MB]

6. Modernising the Charities Act - options to test with stakeholders - charities accumulating funds and charitable business activities [PDF, 1.8MB]

7. Modernising the Charities Act - options to test with stakeholders - reporting requirements for small charities [PDF, 2MB]

8. Modernising the Charities Act - introduction to the regulator [PDF, 2MB]

9. Modernising the Charities Act - introduction to appeals [PDF, 1.5MB]

10. Modernising the Charities Act - introduction to the obligations of charities and officer duties [PDF, 1.5MB]

11. Modernising the Charities Act - options to test with stakeholders - the appeals framework [PDF, 1.2MB]

12. Modernising the Charities Act - options to test with stakeholders - the regulator [PDF, 3.1MB]

13. Modernising the Charities Act - options to test with targeted stakeholders about officers of charities [PDF, 12.5MB]

14. Modernising the Charities Act - Advice on preferred option for charities accumulating funds [PDF, 1.3MB]

15. Modernising the Charities Act - Advice on recommended option for reporting requirements for small charities [PDF, 2.4MB]

16. Modernising the Charities Act - advice on recommended option for officers of charities [PDF, 1.2MB]

17. Final proposals to modernise the Charities Act 2005 [PDF, 3.1MB]

18. Final Cabinet paper on policy proposals to modernise the Charities Act 2005 [PDF, 1.1MB]

19. Modernising the Charities Act 2005 - Minor and technical amendments [PDF, 1.2MB]

20. Modernising the Charities Act 2005 - Taxation Review Authority Powers and Procedures for Charities Act Appeals [PDF, 1.2MB]

Policy documents 2018-2019

- February 2019: Modernising the Charities Act 2005 Discussion document (PDF, 0.72mbs)

- February 2019: Modernising the Charities Act 2005 Quick read (PDF, 5.15mbs)

- February 2019: Cabinet paper: Review of the Charities Act 2005: Release of Discussion Document (PDF, 0.61mbs)

- February 2019: Cabinet Social Wellbeing Committee Minute of Decision: Release of Discussion Document (PDF, 0.64mbs)

- February 2019: Cabinet Minute of Decision: Release of Discussion Document (PDF, .62mbs)

- December 2018: Review of the Charities Act 2005: Engagement Strategy (PDF, 700KB)

- May 2018: Terms of reference (PDF, 217KB)

- May 2018: Cabinet paper: Terms of reference to review the Charities Act 2005 (PDF, 731KB)

- May 2018: Cabinet Social Wellbeing Committee Minute of Decision: Charities Act 2005 Review Terms of Reference (PDF, 663KB)

Contact the team

If you can’t find the information you need on this page or if you have any further questions please email charitiesact@dia.govt.nz