Regulatory changes – Anti-Money Laundering & Countering Financing of Terrorism Act 2009

Return to News and Information

7 July 2023

Background

The Government has issued a package of regulatory amendments to the Anti-Money Laundering and Counter Financing of Terrorism Act 2009 (AML/CFT Act) regime. In response to a review of the AML/CFT Act by the Ministry of Justice Cabinet also agreed to a multi-year work programme to deliver further regulatory and legislative changes. The review also forms part of the Government’s response to the Royal Commission of Inquiry in response to the March 15 attacks in New Zealand.

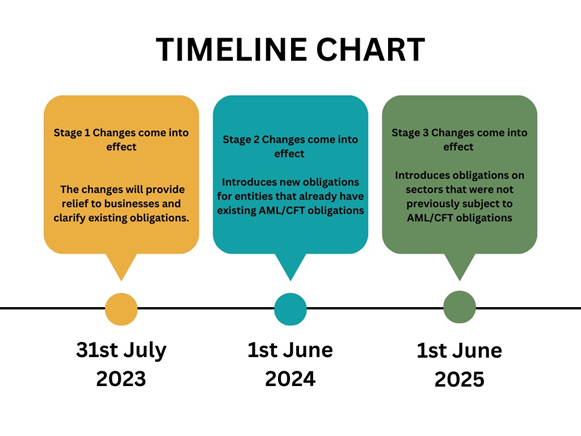

The regulations will come into force in three stages from 31 July 2023 to 1 June 2025.

- The first stage of changes, which came into force on 31 July 2023, provide clarification regarding the application of the AML/CFT Act in some circumstances, as well as regulatory relief in certain situations where risk has been identified as being low.

- The second stage, which comes into force 1 June 2024, introduces new obligations for entities that already have existing AML/CFT obligations.

- The final stage, which comes into force 1 June 2025, introduces new obligations on sectors that were not previously subject to AML/CFT obligations.

Through the review process it became clear that some changes which were intended to come into effect in July 2023 were not suitable to be included in this first stage. Alternative means to bring these changes into effect are being explored. More information on these are available on the Ministry of Justice website.

Why the Changes?

These new changes will reduce the burden on businesses to comply with the AML/CFT Act in areas identified as low-risk (such as exempting registered charities from AML/CFT obligations when they are providing small loans).

The changes will clarify specific parts of existing regulations to:

1. Reduce confusion and cost.

2. Strengthen our ability to prevent money laundering and terrorism financing in New Zealand to fight new or emerging risks.

3. Bring New Zealand in line with international standards and ensure New Zealand continues to be a global champion in protecting our people from the threats of money laundering and the financing of terrorism.

We are currently working on producing guidance for our reporting entities to help them understand the changes and to comply with the new regulations. This will be available shortly.

In the meantime you can learn more about the changes and the process on the Ministry of Justice website.