Regulatory system information: Anti-Money Laundering and Countering Financing of Terrorism

- View a PDF version of this information (PDF, 350KB)

Description of the regulatory system

System objectives/purposes

Context

Each year, approximately $1.3 billion is estimated to be laundered through New Zealand businesses, primarily from illegal drugs and fraud. Organised crime is the primary driver of money laundering in New Zealand, often involving connection to complex transnational networks.

Objectives

The AML/CFT regulatory system requires approximately 7,000 New Zealand businesses to take measures to mitigate the risk that their business is misused for money laundering and terrorism financing.

The anti-money laundering and countering financing of terrorism regulatory system puts practical measures in place to protect New Zealand businesses and makes it harder for criminals to profit from and fund illegal activity. The regulatory system also contributes to New Zealand maintaining its reputation as a country working towards international goals for anti-money laundering and countering financing of terrorism.

The purposes set out in the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 are to:

- detect and deter money laundering and the financing of terrorism;

- maintain and enhance New Zealand’s international reputation by adopting, where appropriate in the New Zealand context, recommendations issued by the Financial Action Task Force; and

- contribute to public confidence in the financial system.

Out of scope of this assessment

This regulatory system assessment considers the areas of the system for which the Department is responsible and has oversight. The Department, in collaboration with other regulatory agencies, monitors and assesses the level of risk of money laundering and financing of terrorism, monitors, investigates and enforces compliance with the Act, provides guidance, and cooperates with domestic and international counterparts to ensure the consistent, effective, and efficient implementation of the Act. Overall policy responsibility for the system sits with the Ministry of Justice.

Key statutes

Anti-Money Laundering and Countering Financing of Terrorism Act 2009

Key regulations

Anti-Money Laundering and Countering Financing of Terrorism (Definitions) Regulations 2011

Anti-Money Laundering and Countering Financing of Terrorism (Exemptions) Regulations 2011

Brief description of what the system does

The system deters, detects and prevents money laundering and the financing of terrorism. It does this by requiring regulated entities (referred to as reporting entities) to have adequate and effective procedures, policies and controls to manage and mitigate the risk that their business will be misused for money laundering or terrorism financing. These controls make it harder for proceeds of crime or funds to support terrorist activities to enter or move through the financial system and harder for money launderers to disguise the origins of the money.

The key requirements on a reporting entity are to undertake an assessment of the money laundering and terrorism financing risks that their business faces and then implement a programme to mitigate these risks. This includes requirements to appoint a compliance officer to maintain the programme, verify identity information about customers performing activities and transactions and, in certain higher risk situations, examine the source of funds or wealth of the customer. A reporting entity must also identify and report suspicious activities, cash transactions of $10,000 or over, and international funds transfers of $1,000 or more to the New Zealand Police Financial Intelligence Unit. Reporting entities must also keep records, ensure that their risk assessment and programme are adequate, effective and kept up to date, and must have their risk assessment and programme audited every two years.

The system is designed to meet standards set for member states by the inter-governmental Financial Action Task Force (FATF). These standards aim to unite member countries to protect the global financial system from money laundering, terrorism financing, and the financing of proliferation of weapons of mass destruction. New Zealand is a member of FATF and the AML/CFT Act responds to the FATF standards. New Zealand is also a member of the Asia Pacific Group on Money Laundering (APG), which is one of nine FATF-style regional bodies.

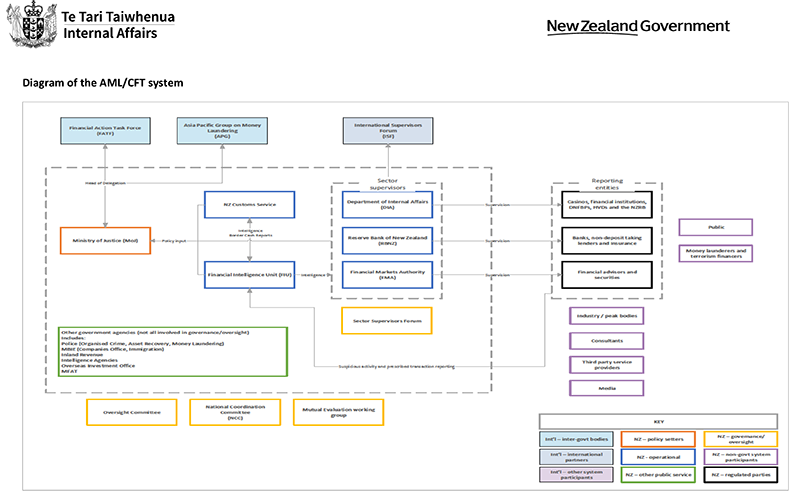

Agencies involved in the anti-money laundering and countering financing of terrorism regulatory system

- The Ministry of Justice is the policy agency for the AML/CFT system. The Ministry administers the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (AML/CFT Act) and regulations and processes applications for exemptions from the legislation. The Ministry also co-ordinates the New Zealand relationship with the FATF and APG.

- There are three supervisory agencies of the AML/CFT Act. Supervisory agencies monitor and assess the implementation and effectiveness of AML/CFT risk assessments and compliance programmes that exist in response to identified risk across all the entities they regulate. They also provide education, guidance, monitor, investigate, and when necessary, enforce compliance with the Act.

- The Reserve Bank supervises banks, life insurers and non-bank deposit takers.

- The Financial Markets Authority (FMA) supervises issuers, supervisors, fund managers, brokers and custodians, financial advisers, and providers of licensed market services.

- The Department of Internal Affairs supervises casinos, non-deposit taking lenders, money changers, money remitters, trust and company service providers, law firms, accounting practices, real estate agents, TAB New Zealand, certain high value dealers, and other entities not supervised by the Reserve Bank or FMA.

- The Financial Intelligence Unit (FIU) within the New Zealand Police receives, collates and analyses suspicious activity reports and prescribed transaction reports, conducts risk assessments and disseminates intelligence to law enforcement and other relevant agencies.

- The New Zealand Customs Service receives and forwards border cash reports to the FIU and is responsible for seizing falsely or non-declared cash.

The Department’s view is that there are good working relationships and well-systematised contact between agencies involved in the system. Processes in place that foster collaboration between these agencies include:

- A Sector Supervisors’ Forum meets fortnightly. Membership consists of the supervisory agencies with the Ministry of Justice and the FIU invited as attendees. This forum discusses operational issues and seeks greater consistency and coordination in supervisory approach. This is working well as a place to discuss operational issues and priorities of mutual interest. There is also a good level of ongoing informal engagement between the supervisors that reflects close working relationships.

- A National Co-ordination Committee is provided for in the AML/CFT Act to ensure the necessary connections between the supervisors, the Commissioner of Police, and other agencies exist. This forum aims to ensure consistent, efficient and effective operation of the system. It meets every two months and is chaired by the Ministry of Justice.

- An Oversight Committee made up of relevant General Managers/Deputy Chief Executives across the key agencies provides a strategic oversight of the New Zealand anti-money laundering and countering financing of terrorism system. The Oversight Committee meets three to four times a year.

- The supervisory agencies are also members of the International Supervisors Forum. This is a group of supervisors from the “Five Eyes” countries (Australia, Canada, New Zealand, the United Kingdom and the United States). This forum meets bi-monthly.

- A FATF International Supervisors Forum that is open to all FATF member countries and aims to meet thrice a year.

- FATF member plenary meetings are open to all FATF member countries and take place three times per year, as well as the APG annual meeting. Representatives from different agencies may attend these meetings on behalf of New Zealand with the Head of Delegation role being held by the Ministry of Justice.

Regulated parties and non-government stakeholders

- Regulated entities, as listed under the supervisory agencies on page 3 (as above).

- Sector peak bodies such as New Zealand Law Society, Chartered Accountants Australia & New Zealand, Real Estate Institute of New Zealand.

- Sector consultants and auditors.

Engagement between system agencies and regulated parties

Processes in place that foster collaboration with these various stakeholders include:

- National and sector risk assessments and the Department’s compliance and enforcement approach are published on its website to provide certainty and predictability for reporting entities. Peak bodies are consulted in developing risk assessments for their sectors.

- An Industry Advisory Group consisting of representatives from peak bodies and reporting entities which meets with the Department four times per year. Most feedback from reporting entities has focussed on requests for increased guidance about specific issues.

- The provision of information and guidance material made available on the Department’s website supported by face-to-face meetings.

Fitness-for-purpose assessment

Reviews/assessments of the anti-money laundering and countering financing of terrorism regulatory system

The AML/CFT Amendment Act 2017 was passed in August 2017 following a comprehensive policy and public consultation process. Before 2017 the system covered financial service providers, some trust and company service providers (TCSPs), and casinos that totalled about 1,000 reporting entities supervised by the Department of Internal Affairs (the Department). With the passage of the Act, approximately 6,000 law firms, accounting practices, real estate agents, additional TCSPs, and certain high value dealers[1] were brought into the system, as well as TAB New Zealand.

A formal FATF evaluation of New Zealand’s compliance with international anti-money laundering and countering financing of terrorism standards concluded in February 2021, with the report published in April 2021.

A statutory review of the Act is due to begin in July 2021 after the FATF evaluation.

Review/assessment findings

Effectiveness

The extent to which the system delivers the intended outcomes and impacts

Objectives and understanding

The system has clear objectives that are well understood by sector supervisors and the policy agency. The system’s regulatory activities are tailored to the money laundering and terrorism financing risk, knowledge and capability of entities. Boundaries between agencies in the system are clear and well-understood but not prohibitive to effective collaboration.

Further, the sectors new to the system since 2017 are still developing their understanding of their ML/TF risks. Reporting entities’ understanding and implementation of their obligations is mixed, with a better understanding and implementation in more sophisticated reporting entities.

Compliance/monitoring

The design of the AML/CFT regulatory system includes the need for independent audits, intended to support reporting entities to better recognise and implement measures to mitigate their money laundering and terrorism financing risks. Once again, with the most recently captured sectors, this additional level of assurance has not been fully embedded and will take time to embed.

Regulatory activities are risk-based and target the highest levels of risk. For the financial service provider and casino sectors, the AML/CFT regulatory agencies have a good understanding of the risk profile and level of compliance. There is ongoing and developing understanding of the risk profile and level of compliance of the recently introduced sectors (lawyers, accountants, real estate agents, and high value dealers).

Enforcement

Enforcement action has been taken against seriously or wilfully non-compliant entities. Various enforcement options are available and used to ensure a graduated, proportionate response to non-compliance (e.g. issue formal warnings, accept enforceable undertakings, civil or criminal prosecutions).

Enforcement has focussed on high-risk sectors, ensuring maximum impact and deterrence. For example, in 2019/20, a civil prosecution resulted in $7.585 million of penalties being awarded against two entities, as well as injunctions restraining two shareholders/directors and the AML/CFT Compliance Officer from future involvement in providing financial services. Another entity was convicted for failing to conduct customer due diligence and report suspicious transactions. Fines of $2.55 million were imposed on the entity and $180,000 and $202,000 on two associated individuals. These prosecutions aim to remove harmful individuals from the system and to be a deterrence to other entities.

Future

There is scope for more detailed understanding of system effectiveness to be developed to support more targeting of the Department’s efforts. Work that could be considered includes clarifying whether any New Zealand and supervisor specific performance framework is needed to support initiatives to improve effectiveness.

Efficiency

The extent to which the system minimises unintended consequences and undue costs and burdens

Current

The system aims to take a risk-based approach that is proportionate and graduated and does not use resources on low impact activities.

While most of the legislation is clear and understandable, some of the requirements are more easily met by large financial institutions than by other types of reporting entities, such as law firms, or real estate agents.

To prepare joint guidance involves developing a consistent view between the supervisory agencies and extensive inter-agency coordination. These activities can be resource intensive and time-consuming. The consequence is that obligations are not fully understood across all sectors, in a timely manner.

Resolving individual issues or exemption applications with reporting entities can take some time, during which an entity is subject to some uncertainty and needs to work more closely with their supervisor as operational decisions are made to manage the situation. This is discussed further below.

Future

The impact of the system on clients of reporting entities is not well understood at this point.

Durability and resilience

How well the system copes with variation, change and pressures

Mechanisms to allow for unanticipated events

To ensure changes in the money laundering and terrorism financing risk profile and wider financial pressures on reporting entities are responded to, monthly sector scanning intelligence reports were introduced by the Department. These are used to identify and mitigate the money laundering and terrorism financing risks, including those associated with COVID-19.

The system has demonstrated it is able to respond at an operational level to issues that emerge and evolve across the different sectors. Compliance interventions are targeted to particular reporting entities and those AML/CFT requirements that align with New Zealand’s highest ML/TF risks. In relation to COVID-19, this included responding to emerging risks from associated predicate offending,[2] such as charity, immigration and identity frauds, and phishing scams. Assessments suggest the latter have increased nationally and globally in recent times. Responses included publishing advice around ML/TF risks, guidance for complying with AML/CFT requirements under alert levels and a compliance strategy if independent audits could not be completed.

COVID-19 has affected reporting entities in different ways and to varying magnitudes. Some reporting entities had to change their AML/CFT policies and procedures to accommodate non-face-to-face customer onboarding (authentication and responding to questions) while also ensuring they maintained compliance with the AML/CFT Act.

Recent adaptation

The legislation was amended in 2017, with new regulated entities brought into the system in 2018/2019. In 2019, a review of two expiring regulations began. The Ministry of Justice intends to seek Cabinet approval for the new regulations by July 2021.

Pressures that may be threatening durability

The supervisory agencies develop guidance, both individually and collaboratively to address need and changes in the system. Due to the challenges of representing different parts of the system through a single lens, this cross-agency guidance is not always timely, and updates can be out of step with Supervisors’ views.

Fairness and accountability

How well the system respects rights and delivers good process

Principles of natural justice are built into the design of the system in a number of ways. Regulatory activities are tailored to the money laundering and terrorism financing risks, knowledge and capability of entities.

Regulated entities are given opportunities to discuss and correct findings about their compliance, as appropriate.

The ongoing need for regulatory intervention indicates that some reporting entities have a lower level of knowledge of, either, their obligations or of how to apply their obligations. Continuing rollout and revision of educational and compliance engagements will reduce the likelihood that unclear requirements are the root cause of non-compliance.

Plans for regulatory and operational improvements

Key regulatory changes planned for 2020/21

The Ministry of Justice is required to commence a statutory review of the anti-money laundering and countering financing of terrorism legislation no later than 1 July 2021. The review may result in recommendations about making amendments to the Act and is intended to take account of the results of the FATF evaluation of New Zealand’s compliance with international anti-money laundering and countering financing of terrorism standards.

Expiring regulations have been reviewed to ensure they are fit-for-purpose and in line with money laundering and terrorism financing risks. Three substantive changes and fifteen technical changes are proposed, along with six new regulations to address situations where the compliance burden is disproportionate to risk and to address urgent issues identified during the review. These changes have been approved and final regulations are expected to be approved by Cabinet and in force by July 2021.

Key service design and operational changes planned for 2020/21

Implementing recommendations from the FATF mutual evaluation

Findings from FATF’s mutual evaluation of New Zealand’s regulatory system were published in April 2021. Some recommendations inform, and are likely to lead to, legislative change, others encourage supervisory effectiveness. The Department is working with other regulatory parties to assess the impact of the recommendations and plan for the improvements that are recommended.

- View a PDF version of this information (PDF, 350KB)